Welcome to this month’s UK property market review from Garrington. As we enter the final quarter of 2024, the...

UK Property Market Review – June 2020

At an exceptional period of time in world history, we consider how so little has been able to happen, yet so much has changed in the property market.

Following Boris Johnson’s unprecedented announcement in March, the property market was effectively ‘furloughed’ during the strictest lockdown period. Around half a million movers were left mid-transaction unable to progress their plans, whilst the country was instructed to stay at home.

Whilst the shock factor and associated uncertainty caused panic amongst some movers, in the main, a pragmatic approach seems to have been adopted by most.

Echoing the short notice to lockdown commencing, short notice was also given that on the 13th May the property market could re-open, albeit in England only. At the time of writing formal notification is still awaited for the rest of the UK’s devolved regions.

Early signs

Whilst the market was on pause there was much speculation about how the UK property market would be impacted by the pandemic. Given the grim economic outlook, many commentators have predicted that it is to be expected that the market will be adversely affected too, given its intrinsic links to employment and consumer confidence.

Yet to many people’s surprise, the English property market has been exceptionally brisk over recent weeks. Weeks of reflection, and being cooped up in the same four walls, have led some to decide that what they want from their home has changed.

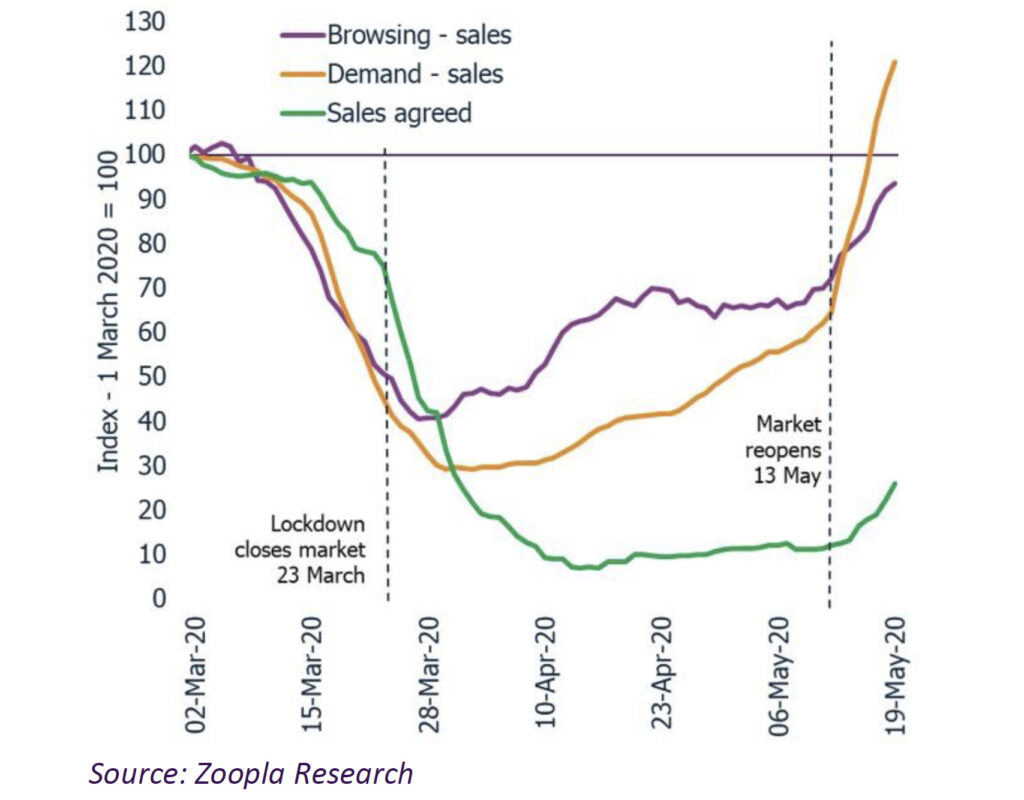

On the front line this attitude has manifested itself in the emergence of a steady stream of determined buyers who have made life-changing decisions during lockdown and are now keen to capitalise on the current volatile market. Sales agents are reporting business levels as being back to around 60% compared to last year at this time and a four fold increase in applicant registrations over recent weeks; although sales rate are still lagging behind.

Accelerating regional disparities mean that depending on location, property type and price, it is both a buyer’s and a seller’s market. England’s post-lockdown bounce in activity may ease, but for now it is running on a combination of pent-up demand and a period of rapid transition.

Diverging data

Price earning ratios had already polarised many of the UK’s regional markets, but for anyone trying to accurately read the property market, the task is near impossible at a national level and the limited data that is available conflicts dramatically.

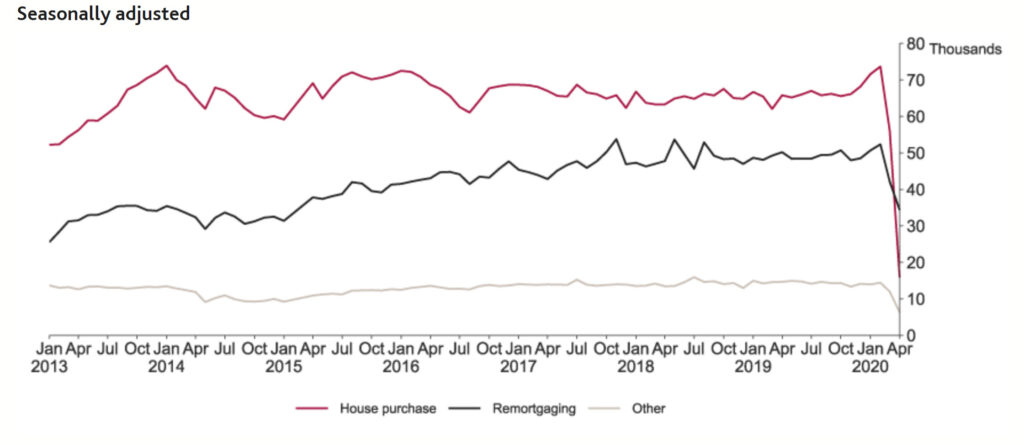

Mortgage approvals, which are normally seen as a reliable forward indicator of purchaser demand, fell to 15,800 in April. This is 80% lower than last year according to the Bank of England. In complete contrast, Rightmove has recorded its highest ever number of site visitors on 27th May. The portal recorded six million visits to the site for the first time, which represents a 18% increase year on year.

The Land Registry has suspended its normal house price index given historically low levels of data. As such, in all probability, it will not be until late summer that any meaningful patterns can be identified. Nationwide recorded average house prices falling by 1.7% in May, but for all the reasons stated, this should not be considered a useful or accurate barometer – the market is far more fractured and complex than this headline figure would suggest.

Revised priorities

As previously mentioned, the lockdown has created a period of reflection and with it a number of buyers’ plans are being driven by a conscious decision to live in a different type of property or location. Science tells us that habits and norms are formed after repeating something for 66 days. The huge amount of working from home looks to be one of the lasting norms for many workers and as such, a dedicated space for working sits high on the list of requirements for many buyers – aligned with excellent internet speeds.

Research from both Dataloft and Nationwide contains similar findings; that outdoor space is the highest priority amongst purchasers, together with community and broadband availability.

Across our regional offices, Garrington has seen strong demand amongst new clients both switching their lifestyles but also looking for an additional property. Finding a location that can cater for these new needs is now more of a consideration than ever.

Given the depth of thought and planning that has gone into these purchasing decisions, we believe that this is not just a short term blip, but more of an intensification of a trend we previously reported in our prime movers report last year – albeit being buoyed by a different set of drivers.

Challenges and opportunities

So far, the property market is showing an unexpected level of resilience. It is far too premature to consider current market conditions as a form of ‘new-norm’, and we remain very much in a period of transition – but to exactly where, remains the lingering question that only time will reveal.

There are a number of additional factors that could be a drag on the market. Mortgage payment holidays and the employee furlough scheme both ending around the same time, as well as the US election will all add to the volatility later in the year.

At the same time, the Prime Minister’s suggestion of some of the “biggest changes in our visa system in British history” could open the door to 2.5 million Hong Kong residents eligible to apply for British National passports. Garrington has already seen an upturn in buyers from Hong Kong looking to relocate their families to the UK.

Despite the July spending review being delayed due to Covid-19, there remains speculation that the government is considering some type of Stamp Duty reform or temporary payment holiday to support the property market and the stimulus it in turns provides to other sectors of the economy.

The only certainty at the moment is that change is happening, and at a pace and scale never seen before. Garrington will be regularly sharing insights and the latest information we have available over the coming weeks.