The UK property market begins 2026 with renewed energy. Following the protracted uncertainty that clouded late 2025, last...

UK Property Market – August 2025 | Resilient Demand, Softer Prices

A warm welcome to Garrington’s latest UK property market review.

As summer reaches its tail end, transactional activity across the UK housing market is holding firmer than many expected. While August is typically characterised by a seasonal slowdown, Garrington is observing higher-than-usual levels of buyer engagement, particularly among those returning from summer breaks with clear intentions to act.

Rather than a wave of exuberance, the compound effect of softer asking prices and lower mortgage rates is underpinning this revived activity.

While sentiment remains cautious, the UK property market is benefitting from an increasingly pragmatic alignment between buyers and sellers, where price reductions are starting to unlock previously paused moves.

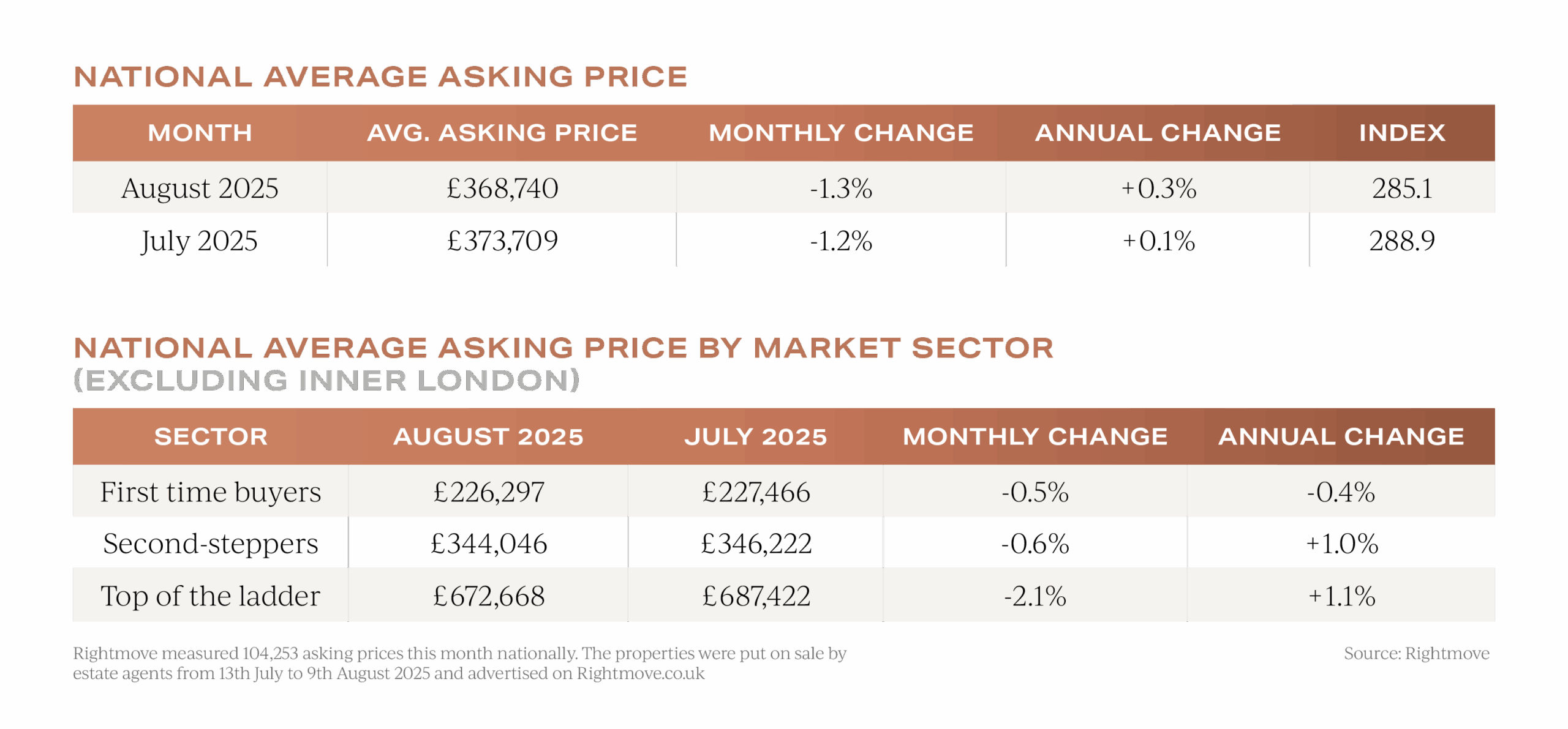

House prices stabilise, with soft monthly growth

July saw a continuation of modest house price growth across the UK. Nationwide reported a 0.6% monthly increase, pushing annual growth to 2.4%, marking its strongest reading since early 2023. Halifax, meanwhile, registered a 0.4% monthly rise, matching Nationwide’s annual figure of 2.4%, and pointing to a market gradually gaining traction. Despite consistent headlines, both indices continue to show regional variance beneath the national average.

Despite consistent headlines, both indices continue to show regional variance beneath the national average.

Halifax highlighted that Northern Ireland and the North West of England are posting the strongest year-on-year growth, while South East England remains the most subdued. These figures mirror what Garrington is seeing on the ground: a market where recovery is uneven, but directionally stable.

Price sensitivity brings prime UK property market back to life

At the upper end of the market, vendors are responding to more cautious buyer sentiment with noticeable price adjustments. Rightmove’s August data shows that homes in the “top-of-the-ladder” category saw the steepest average asking price reductions.

Sellers of these properties have, in many cases, trimmed expectations more substantially than those at lower levels, contributing to a gradual pickup in activity among prime buyers.

Sellers of these properties have, in many cases, trimmed expectations more substantially than those at lower levels, contributing to a gradual pickup in activity among prime buyers.

Garrington is seeing that the discretionary nature of many prime moves has led to a longer-than-usual decision cycle this year. But with borrowing costs easing, and asking prices becoming more grounded, rising numbers of these buyers are re-engaging – often with greater conviction and clearer requirements than in the spring.

Tax reform speculation stirs discussion

Speculation is mounting around potential reforms to property taxation, following reports of leaked proposals from within the Treasury. The most widely discussed change is the possible abolition of stamp duty, replaced either by a seller-side levy or a proportional annual tax based on property value.

No formal policy has been announced, and it remains plausible that these ideas have been floated to gauge public and market sentiment ahead of the Autumn Statement. Yet even in the absence of detail, discussion is gathering pace.

What is being suggested could represent a material shift in the cost and structure of transacting, particularly for those in the upper quartile of the market.

Rumours suggest changes could apply to properties valued from £500,000 upwards, a threshold that would encompass much of the prime and family home sectors in many parts of the UK. For these households, a seller-side charge may reshape decisions around timing, pricing, and the perceived cost of moving.

For others, such reform could be more welcome. Removing the need for a lump sum cash outlay may reduce friction in the buying process, and for many, a deduction from sale proceeds might feel less punitive than calling on savings to meet existing stamp duty charges.

The market has not yet responded with hesitation, but history suggests that the impact will depend entirely on the detail, and until clarity arrives, discussion will continue to shape expectations.

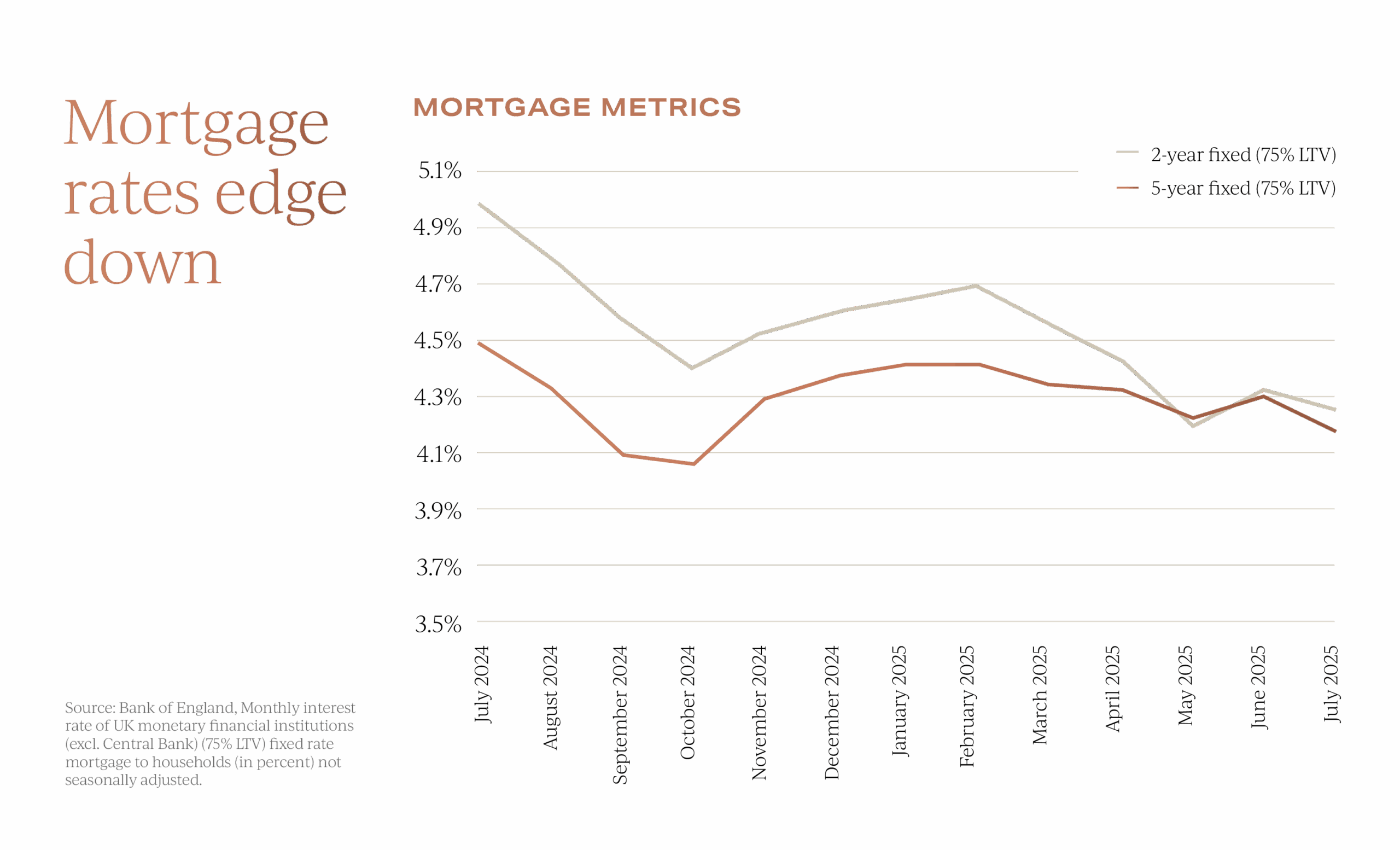

Mortgage markets shift gear

Following August’s base rate cut, borrowing costs have eased further. The average two-year fixed rate (75% LTV) now stands at 4.25%, down from 4.99% a year ago. The five-year fixed rate has slipped to 4.18%, from 4.49% in July 2024. Some lenders are now quoting rates as low as 3.7%, helped by falling swap rates ahead of the Bank’s August decision.

That said, this improvement may not persist at the same pace. While the Bank of England has now delivered five rate cuts in the past twelve months, a split vote at the latest Monetary Policy Committee meeting has cast some doubt over the likelihood of further reductions this year. Inflation is expected to peak at 4% in September, before declining more gradually toward the 2% target by 2027.

Mortgage product choice has edged down to 6,842 products, slightly below July’s figure but still above the 6,657 available a year ago. The average shelf life has risen to 17 days, as lenders adopt a more considered approach to product repricing.

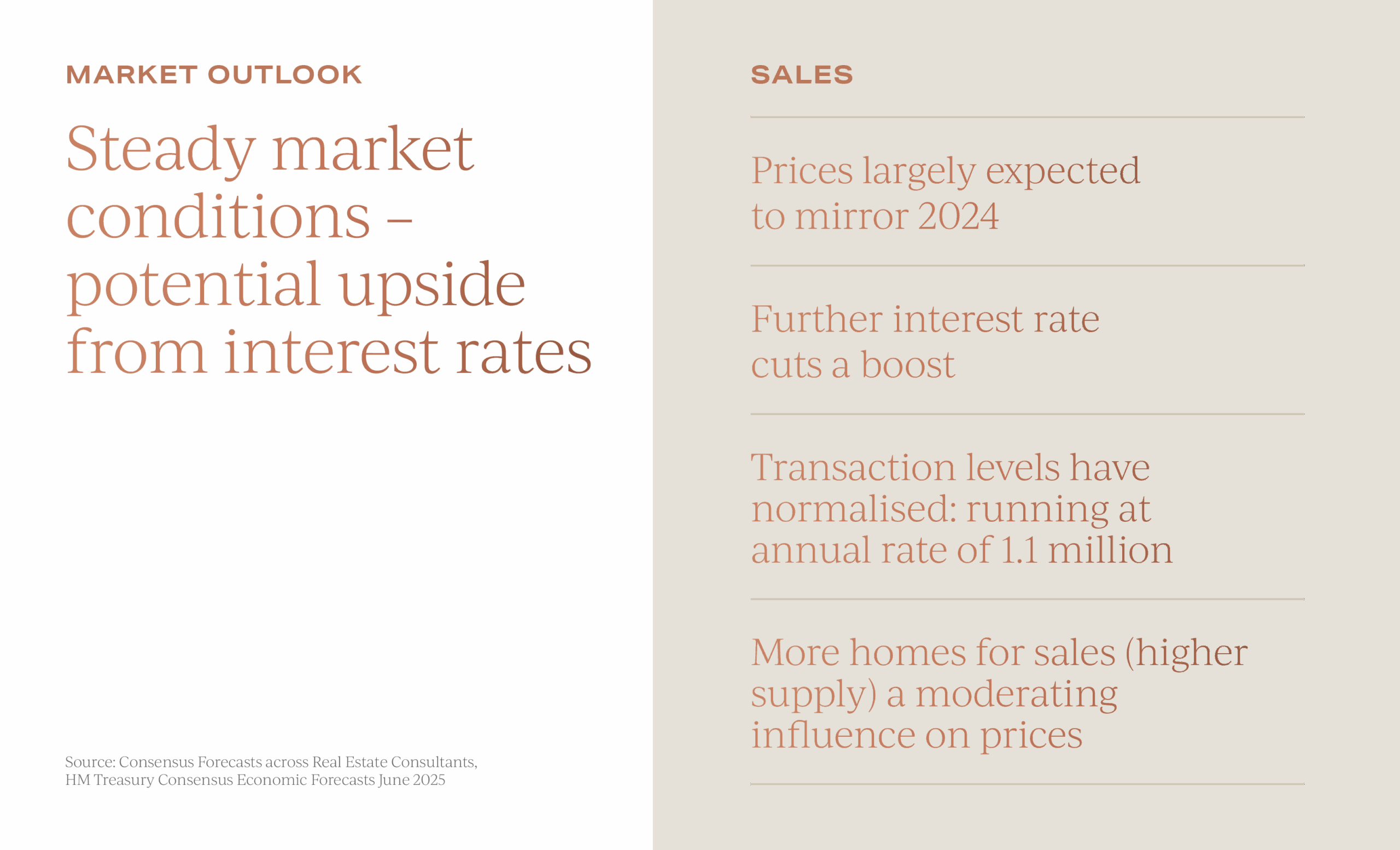

A balanced, if cautious, UK property market outlook

The UK property market entered 2025 with robust momentum, particularly from first-time buyers racing to beat the end of stamp duty relief. Since then, activity has softened but remained stable. Hometrack data confirms a national picture of continued resilience, with year-to-date transactions up 30% compared with the same period in 2024.

Looking ahead, most forecasts point to steady but unremarkable price growth. With the supply of homes for sale rising, pricing will likely remain moderate, with higher availability helping to dampen any inflationary pressure.

Sentiment is improving but is not euphoric. Garrington expects activity to remain stable through early autumn, with further upside dependent on clarity around taxation, inflation, and the Bank of England’s next move.

If you or someone you know is considering moving this autumn, Garrington’s Best Places to Live research provides a valuable resource. The interactive tool allows users to compare locations across the UK based on a range of lifestyle and investment factors, helping buyers shape their thinking and refine their search.

Garrington’s team of advisors are here to help you navigate the UK property market and secure the right property with confidence. To discuss your plans, please do get in touch.