As the year concludes, the UK property market is gradually regaining its composure after an autumn shaped by speculation,...

Realism Driving Summer Sales in the UK Property Market

A warm welcome to Garrington’s latest UK property market review.

July has arrived bringing heatwaves, outdoor events, and a much-needed shift in pace for many. With the summer calendar full of sport, concerts and travel, this is traditionally a time when day-to-day life pauses and priorities come into focus. For some, that includes reconsidering where and how they want to live.

But while the season feels lively and at times intense, the property market is moving with a steadier rhythm.

At Garrington, we are seeing renewed interest from buyers who stepped back earlier in the year, now returning with greater clarity and intent.

International demand is evolving too, with many would-be buyers favouring second homes or flexible UK bases, rather than full relocations.

While interest rates held steady in June, lingering inflation concerns and uncertainty over future tax policy are keeping some buyers on the sidelines. Sellers, meanwhile, are showing signs of fatigue and are beginning to price with greater realism.

Stock builds, but realism drives sales

In what may be the start of a new trend, previously reduced property, which has subsequently sold, is now manifesting in recorded average house price indices. Nationwide reports a 0.8% drop in UK house prices for June, bringing the quarterly figure to -0.5%, down from a 1.1% rise just three months prior. Garrington is seeing similar shifts. The UK property market is recalibrating due to an imbalance created from an influx of listings but not enough committed buyers.

Garrington is seeing similar shifts. The UK property market is recalibrating due to an imbalance created from an influx of listings but not enough committed buyers.

Rightmove shows a 0.3% fall in new seller asking prices, an unusual move in June, but one that reflects growing competition among homes for sale and the need to stand out. Halifax reports that house prices remained flat in June, following a 0.3% decline in May, indicating a stabilising market amid ongoing affordability challenges.

Properties are not selling unless pricing aligns with today’s reality. Minor reductions no longer sway buyers; instead, decisive cuts are what’s driving transactions. As a result, June delivered the highest sales activity since March 2022, according to Rightmove.

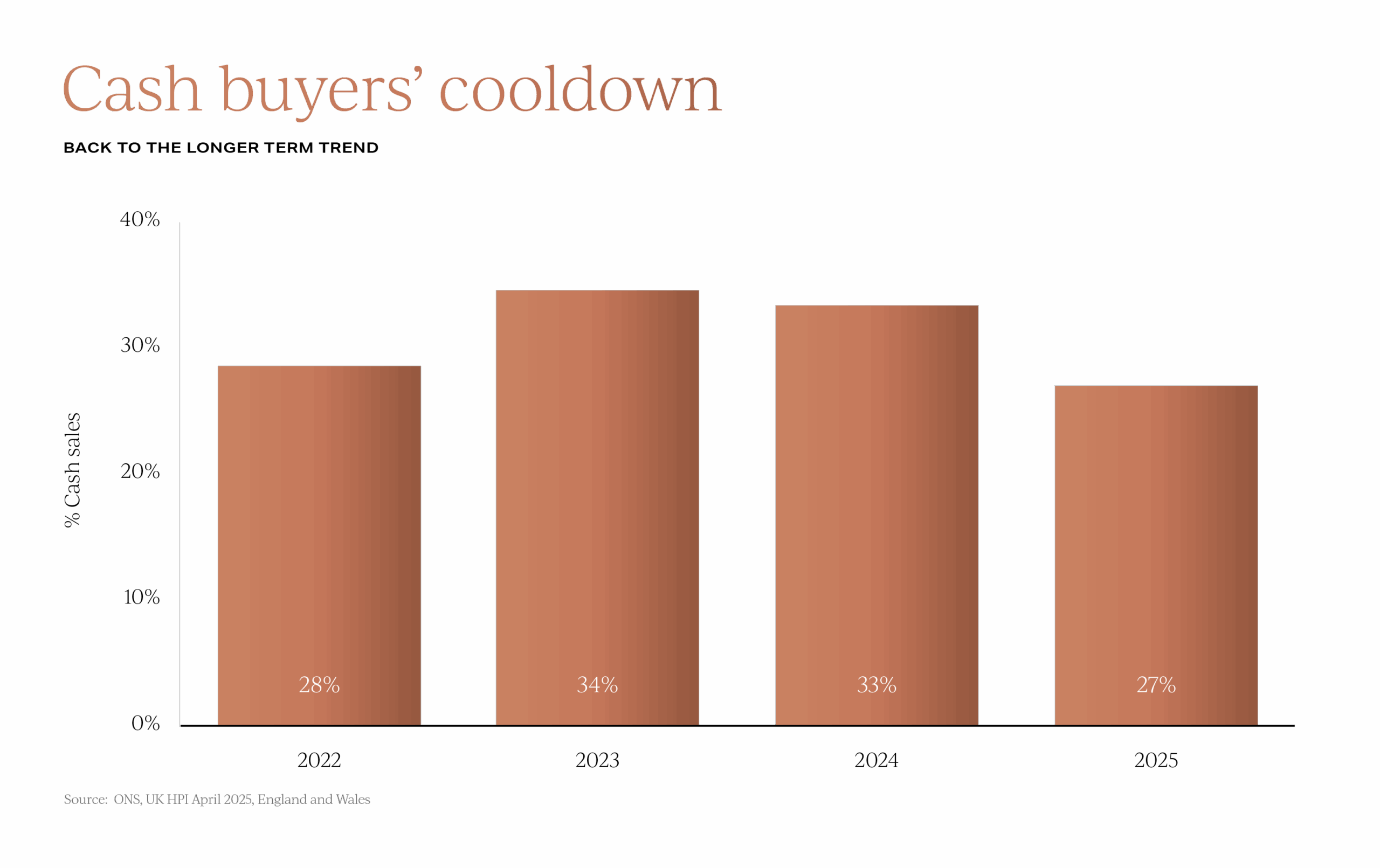

Cash buyers step back, dynamics shift in the UK property market

Cash buyers have been more active over recent years, particularly in the prime market. However, the proportion of cash buyers has slipped from 34% in 2023 to 27% in 2025, according to ONS data. This brings the market closer to historic norms and reflects a more cautious stance among equity-rich purchasers. This matters. Fewer cash buyers could mean longer chains and less dominance at the upper end. Garrington is seeing more complex negotiations, but also more creative ones. Those who are able to move quickly and finance flexibly are now at an advantage.

This matters. Fewer cash buyers could mean longer chains and less dominance at the upper end. Garrington is seeing more complex negotiations, but also more creative ones. Those who are able to move quickly and finance flexibly are now at an advantage.

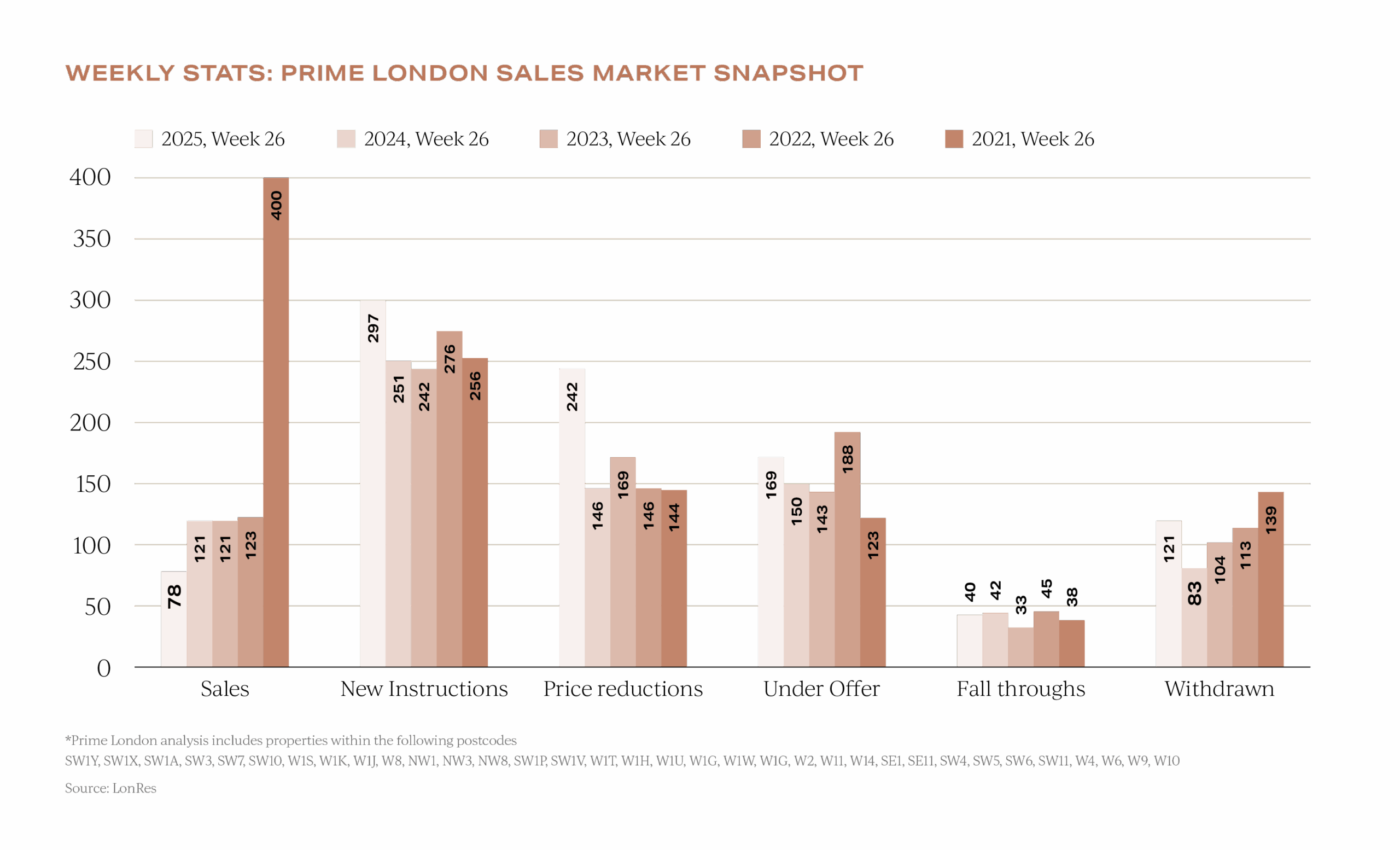

Prime London at the halfway mark

The prime London market continues to show signs of resetting. At exactly the half way point of the year, in Week 26, sales agreed were down 35% year-on-year, even as new listings rose by 18% and week-on-week sales ticked up by 7%. The imbalance is becoming a clear trend rather than a blip. But this isn’t a distressed environment. Garrington continues to achieve substantial discounts for buyers at the top end, not because vendors are forced to sell, but because they value certainty. Significant reductions are an increasingly accepted part of prime deals.

But this isn’t a distressed environment. Garrington continues to achieve substantial discounts for buyers at the top end, not because vendors are forced to sell, but because they value certainty. Significant reductions are an increasingly accepted part of prime deals.

International interest remains, particularly from U.S. buyers who see London as a long-term hub, not a tax shelter.

Meanwhile, domestic prime buyers are stepping in with purpose. With non-dom reforms potentially subject to further revision, many international buyers are pausing and re-evaluating their plans.

Winners and strugglers

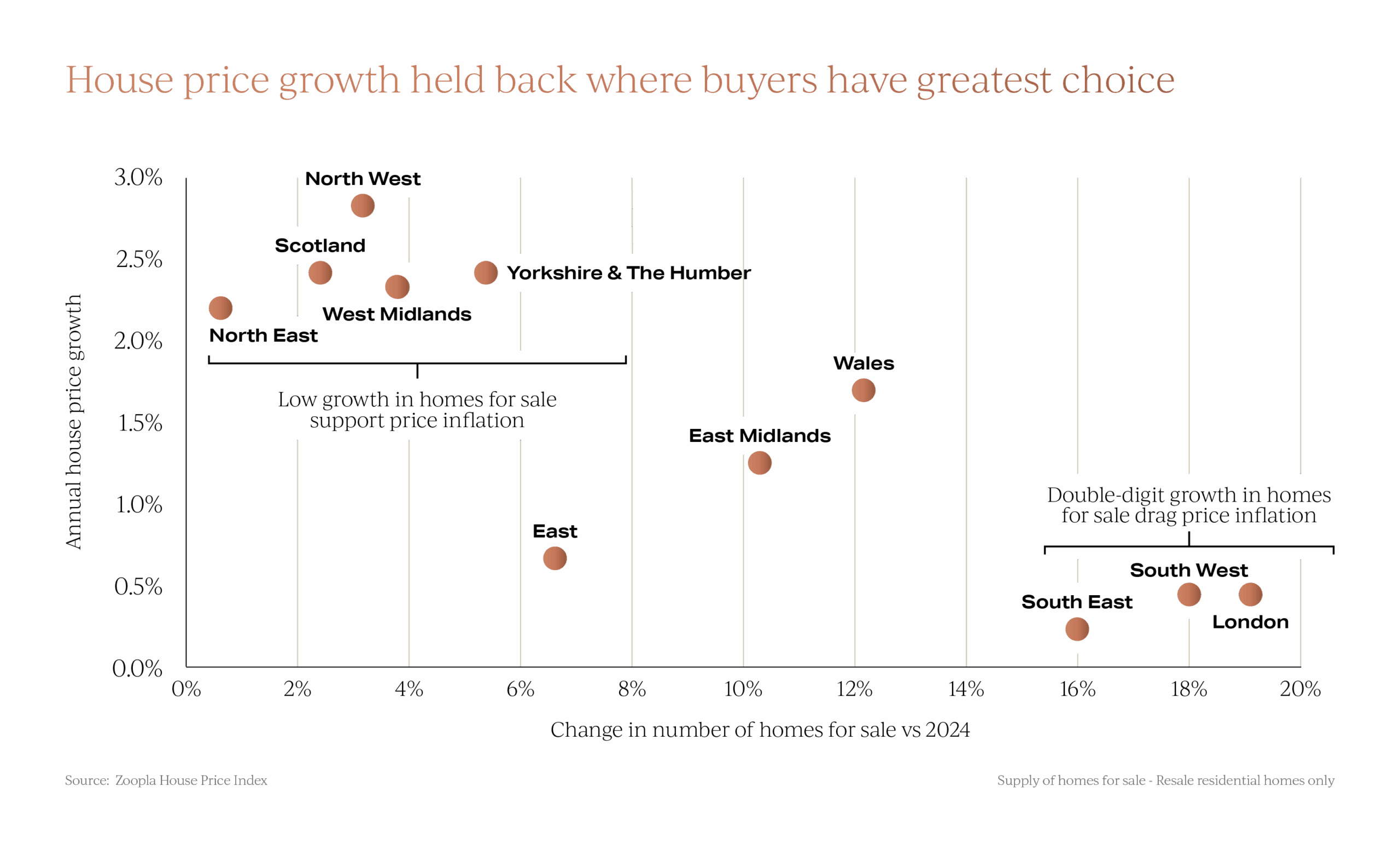

House price growth has become even more localised. Hometrack reports UK-wide inflation at 1.4%, but the breakdown tells the fuller story.

New data underlines the link between house price movements and volume of stock for sale.

In London and the southern regions, specifically the South East and South West, the supply of homes for sale has increased significantly, with listings up by 16–19% compared to this time last year.

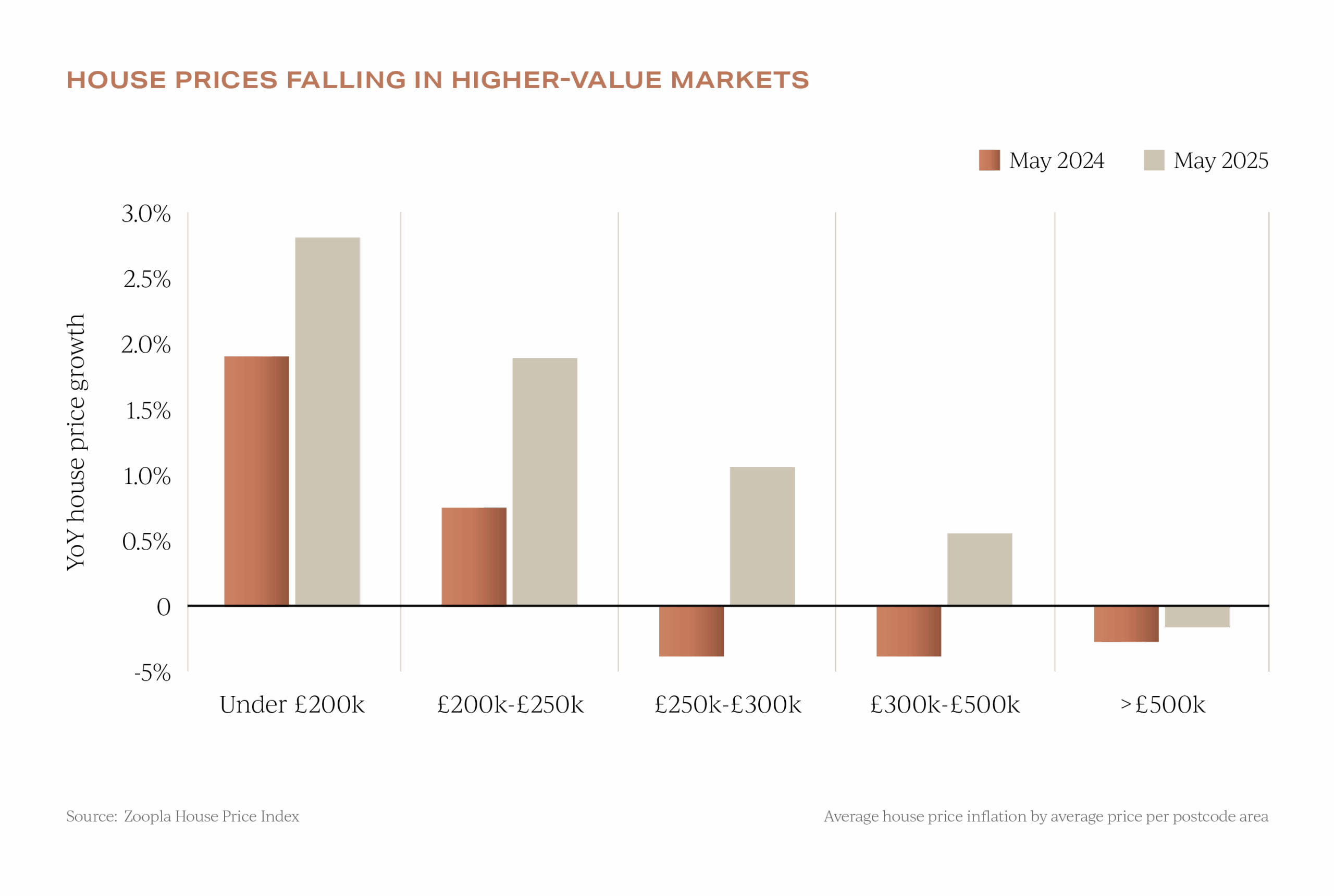

Despite this rise in availability, house prices have remained virtually static, recording growth of less than 0.5% annually. Meanwhile, in the North, West Midlands and Scotland, the volume of new property coming to market has changed only slightly. This limited supply is maintaining a degree of scarcity, which in turn is helping to drive annual price growth in these areas to a more robust 2–3%. The strongest price growth is evident in lower-value markets, which are up 2.7% where average prices are under £200,000, and 1.9% in areas priced between £200,000 and £250,000. Together, these segments make up half of all UK homes.

The strongest price growth is evident in lower-value markets, which are up 2.7% where average prices are under £200,000, and 1.9% in areas priced between £200,000 and £250,000. Together, these segments make up half of all UK homes.

At the other end of the scale, higher-value prime areas, those with average prices above £500,000, are under more pressure. These make up just 8% of the market with small annual price falls of around 0.2% as affordability continues to weigh on demand.

Realism is the common thread. Whether it’s a flat in Brighton or a townhouse in Belgravia, the properties that are selling are those priced for today’s market, not yesterday’s.

Realism is the common thread. Whether it’s a flat in Brighton or a townhouse in Belgravia, the properties that are selling are those priced for today’s market, not yesterday’s.

What’s ahead for the UK property market?

The UK property market is showing signs of intent this summer. Buyers and sellers are engaging, but on revised terms. Inflation and tax are watchpoints but not deal-breakers; instead, they’re shaping a more balanced playing field.

Garrington continues to support clients across the UK, helping them navigate this changing environment. For those ready to act with clarity and confidence, opportunities remain.

For those at the early stages of planning a move, Garrington’s Best Places to Live research provides a valuable resource. The interactive tool allows users to compare locations across the UK based on a range of lifestyle and investment factors, helping buyers shape their thinking and refine their search.

Garrington’s team of advisors are here to help you navigate the UK property market and secure the right property with confidence. To discuss your plans, please do get in touch.