As the year concludes, the UK property market is gradually regaining its composure after an autumn shaped by speculation,...

UK Property Market: Calm on the Surface, Tension Beneath

Welcome to Garrington’s latest UK property market review.

The UK housing market has entered autumn with a tone of quiet steadiness. After a year of shifting expectations and political noise, activity levels have neither surged nor stalled. Instead, the market appears to be catching its breath, balanced between resilient demand in some sectors and rising caution in others.

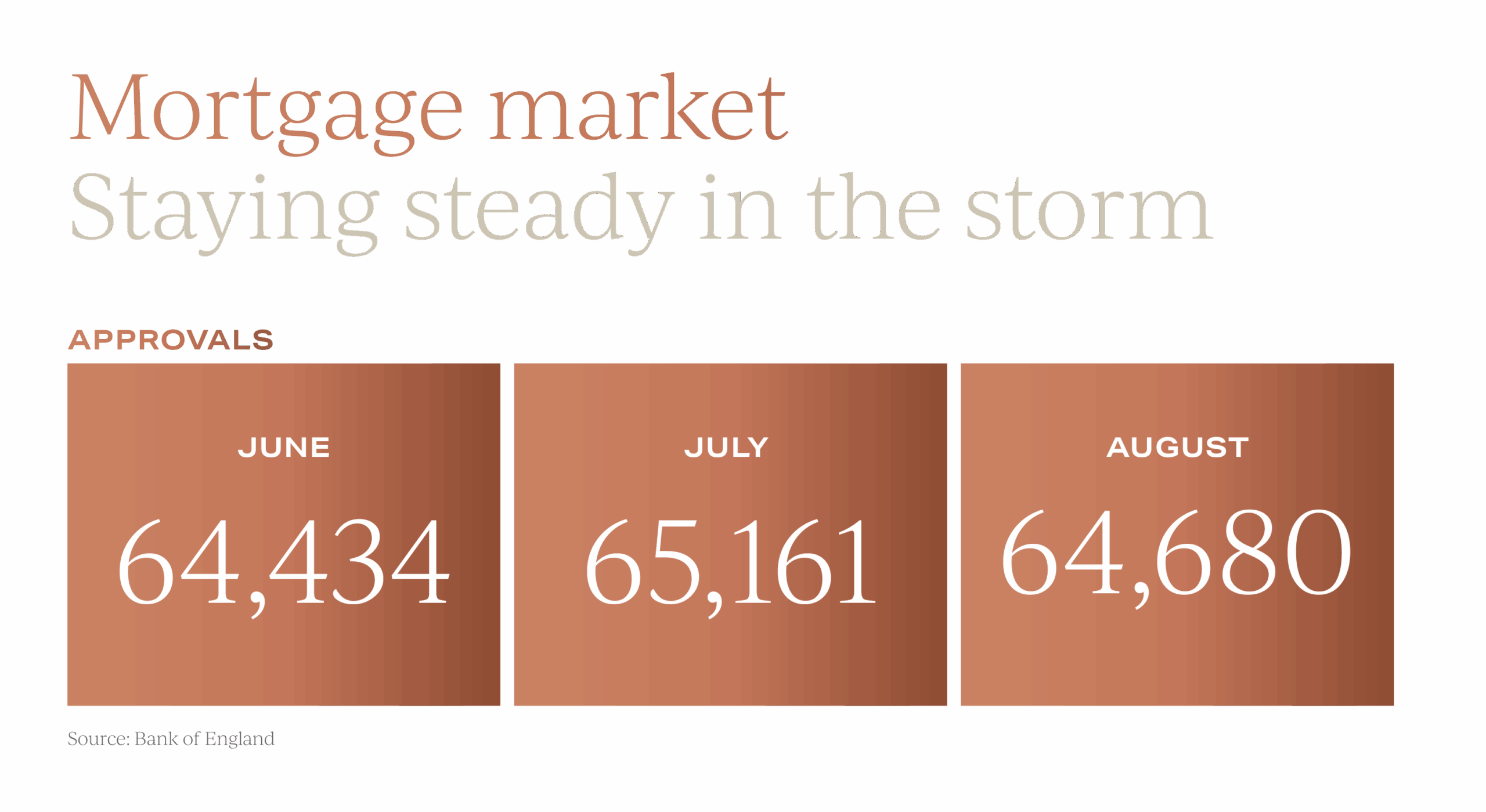

The mortgage market has been the anchor in this period of calm. Bank of England data shows 64,680 approvals in August, only marginally below July’s figure, confirming that lending activity has stabilised. Borrowers are no longer reacting to rate changes; they’re adapting to them.

For now, the tone is not one of hesitation, but of calculation, a market pausing to think, not to stop.

Split momentum in the UK property market

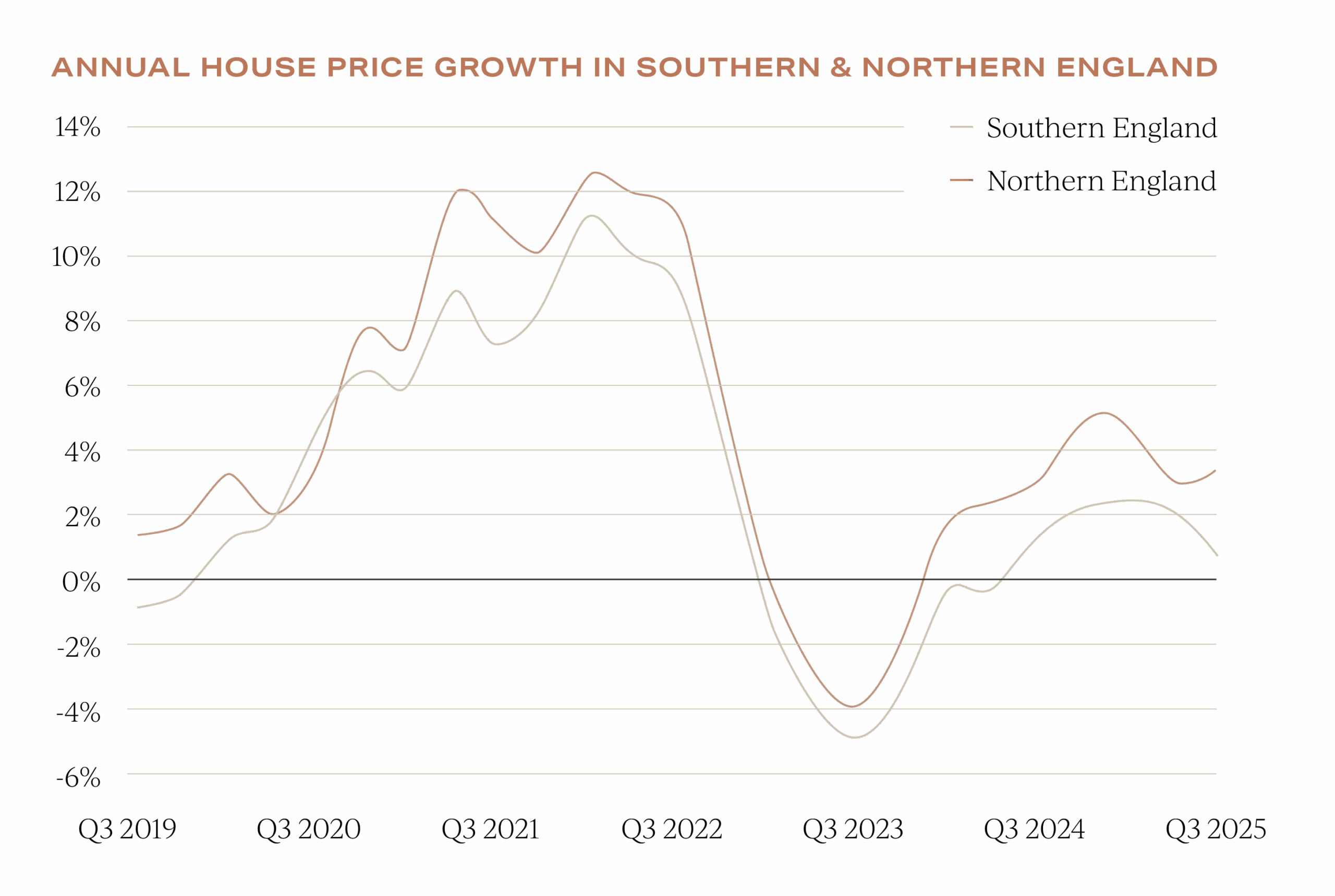

The UK property market is once again running in two gears. According to Nationwide, average prices edged up 0.5% in September, leaving annual growth at 2.2%, with the Midlands and northern regions continuing to outperform the South.

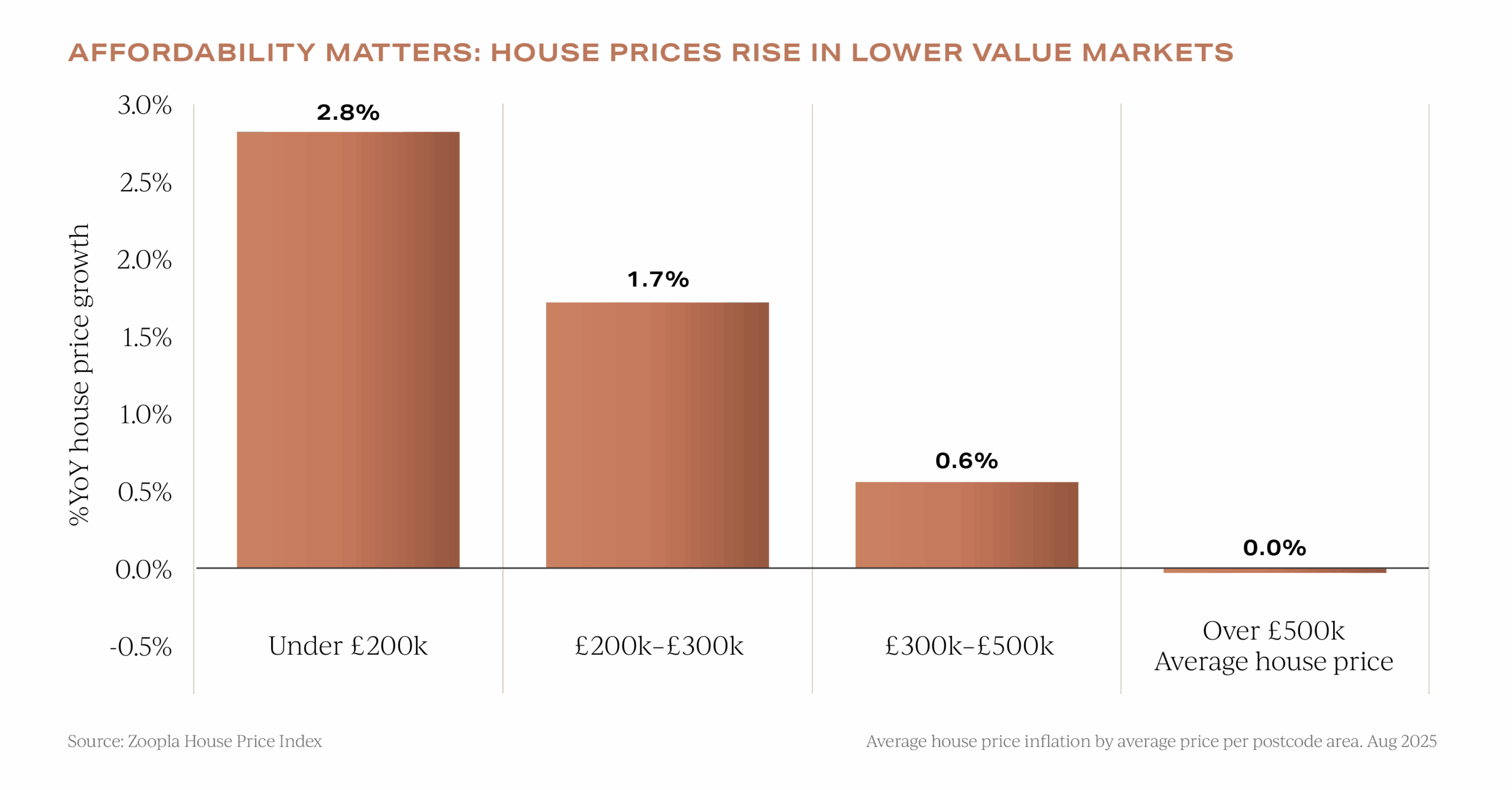

Hometrack’s latest data shows similar moderation, with UK house price inflation at 1.4% in August, but strong divergence beneath the surface: growth of up to 2.8% in lower-value markets under £200,000, compared with flat or negative values above £500,000.

Rightmove’s September index paints the same picture from another angle. Asking prices rose 0.4% month-on-month but slipped 0.1% year-on-year, as London and southern England underperformed while sales elsewhere remained brisk.

The South now has 9% more homes for sale than a year ago, compared with just 2% across the rest of the country, a clear sign of regional imbalance.

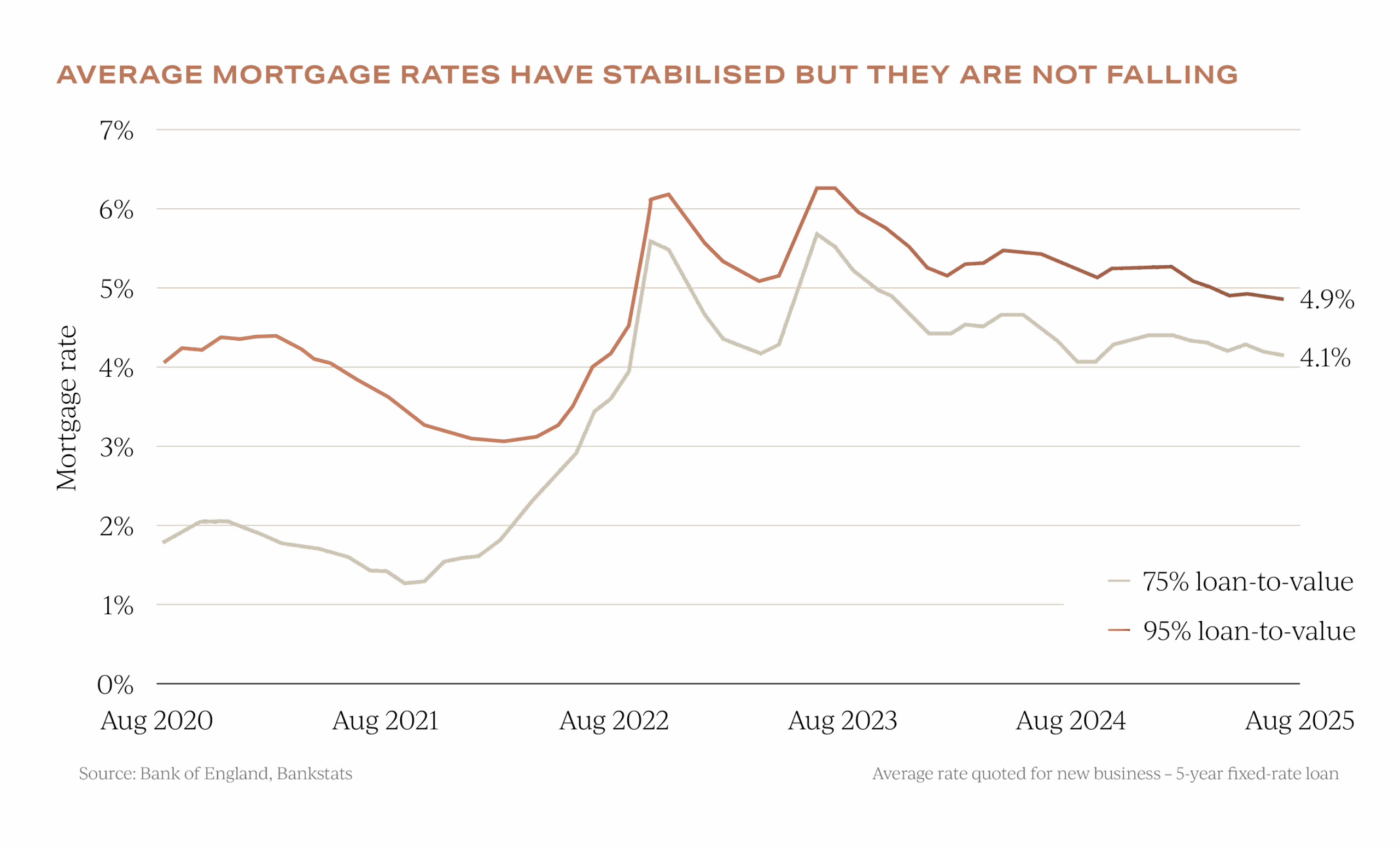

Mortgage conditions have remained supportive, even if not improving. Zoopla notes that average five-year fixed rates are holding between 4% and 5%, with lenders having subtly loosened affordability criteria.

Buyers can now afford to borrow around 20% more than six months ago on the same income and rate, helping to sustain mainstream demand.

Pause for Thought

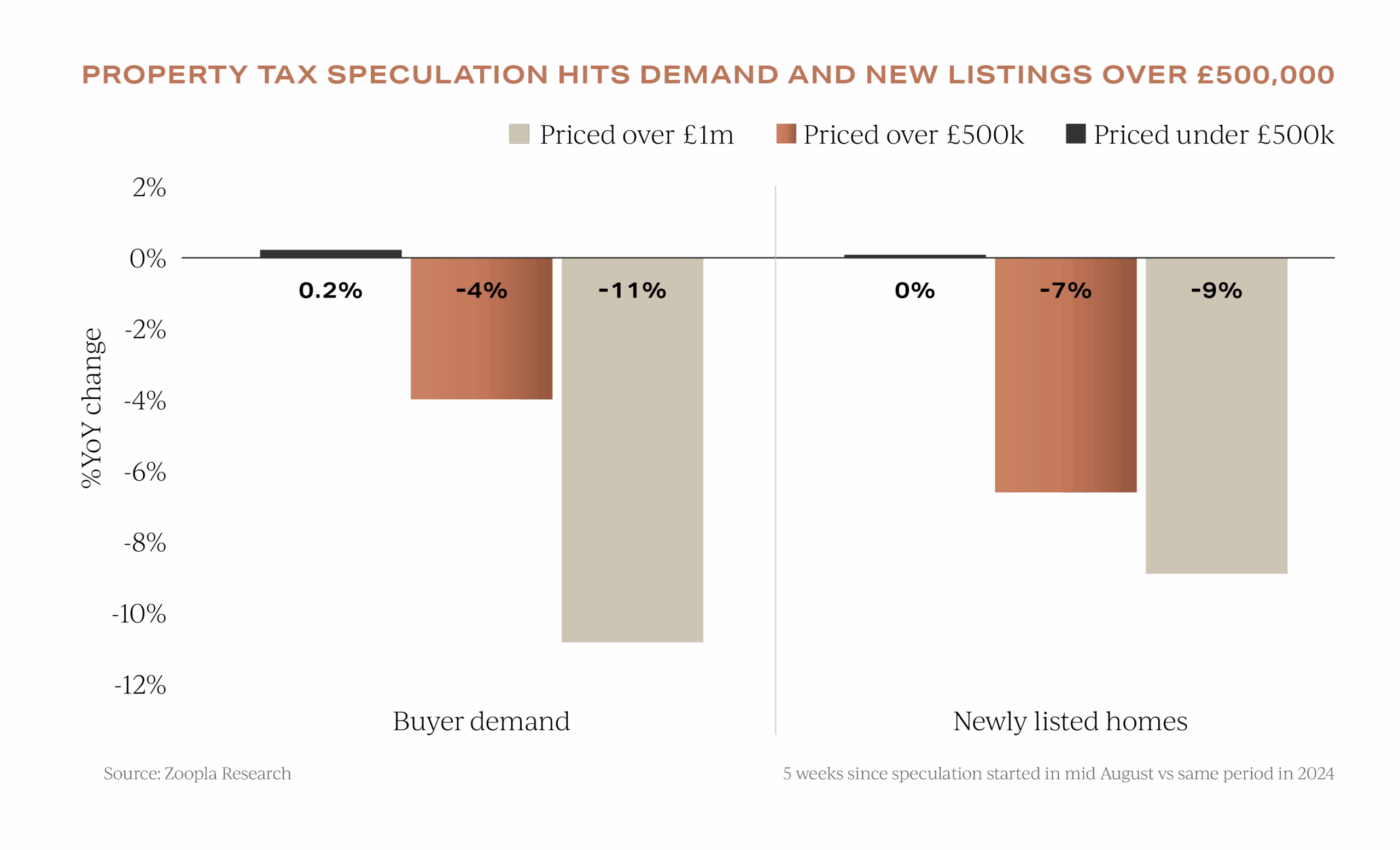

If the wider UK property market is steady, the prime sector is anything but. A wave of tax speculation has unsettled sentiment, triggering what can be described as a “pause for thought” across higher-value markets.

Zoopla reports that buyer demand for homes priced above £1 million is down 11% compared with a year ago, and listings of properties over £500,000 have also fallen as sellers wait to see how the fiscal landscape evolves.

Garrington’s observations echo this restraint. Many prime sales agents are now advising clients not to chase the market lower. Price cuts are becoming counterproductive in a landscape where the issue is not pricing, but one of confidence.

In the same vein, industry price data shows that the traditional premiums for top locations have narrowed sharply over the past decade. For example, buyers can now secure a Chelsea postcode for only a 21% uplift on Fulham, compared with almost 50% ten years ago.

This narrowing of values could, paradoxically, signal opportunity. For those ready to act, today’s muted sentiment may offer a rare window for value-driven acquisitions before clarity returns.

From Reform to Reassurance

The speculation unsettling the top end of the market has deep roots in policy debate. The Independent Housing Policy & Delivery Oversight Committee, led by Sir Vince Cable, has called for wholesale reform of the property tax system, arguing that piecemeal tweaks would only worsen affordability and that a full-scale overhaul is “almost unarguable”.

Against that backdrop, the Chancellor has moved to calm nerves. In a Bloomberg TV interview at the annual Labour Party Conference, Rachel Reeves ruled out the introduction of a standalone wealth tax.

Still, the speculation itself has already had tangible impact. Rightmove’s data confirms that while overall activity remains steady, any new levy on high-value properties would fall disproportionately on the South, where 59% of agreed sales are above £500,000, compared with 22% elsewhere in England.

Buy-to-Let 2.0

While parts of the market are pausing, another is quietly reawakening. Garrington has recorded a steady uptick in investor enquiries over recent weeks, driven by falling borrowing costs, rising rental yields, and a renewed appetite for diversification.

Yet this isn’t a revival of the former landlord class; it’s the emergence of what Garrington is terming Buy-to-Let 2.0: a more professional, structured investor profile.

The amateur landlord has been retreating for some time. What’s taking shape in their place is a business model: investors purchasing through corporate vehicles, adopting long-term yield strategies, and treating compliance, EPC upgrades, and financing as part of a wider investment discipline.

Zoopla’s regional data supports this shift. Markets with lower price entry points, where yields remain attractive, are showing the strongest annual growth.

For investors thinking strategically, these areas represent the balance of affordability, yield, and capital appreciation.

Garrington expects this evolution to continue. A professionalised investor base is not only adapting to the new regulatory environment but is helping reintroduce liquidity into segments of the market where rental demand is unrelenting.

A divided autumn in the UK property market

October finds the market split neatly in two. Those who “need to move” are pressing ahead, often negotiating decisively to de-risk potential policy shocks. And those who “want to move” are sitting tight until the Budget in November brings clarity.

For now, the housing market remains stable but sensitive. Garrington’s view is that this period of caution is likely to prove temporary; confidence, once restored, will reawaken dormant demand. In the meantime, the ability to interpret and act decisively in uncertain conditions will remain the true differentiator.

In a marketplace where, for many purchasers, there are more questions than answers, access to clear and impartial guidance has never been more valuable.

Responding to rising demand, Garrington has introduced a dedicated Property Advisory Service, designed for movers at the planning or research stage, whether exploring the best locations to live, assessing options, or seeking tactical advice on a property already identified.

As the Budget approaches, Garrington will continue monitoring conditions closely and report next month on any emerging clarity or further policy signals.