The UK property market begins 2026 with renewed energy. Following the protracted uncertainty that clouded late 2025, last...

Autumn Budget Impact on the UK Property Market

After months of rumour and political noise, the Autumn Budget finally delivers clarity on the government’s fiscal direction.

In a climate shaped by speculation over wealth taxes, limited fiscal headroom, and demands for growth, the Budget sets out a path that matters profoundly for homeowners, investors and those planning a move.

Reactions across the sector range from relief to disappointment. While some measures are symbolic, others carry real weight for affordability, investor sentiment and long-term planning. Garrington’s view is that clarity itself is now one of the market’s most valuable commodities, and, if nothing else, the Autumn Budget provides it.

Too valuable to change

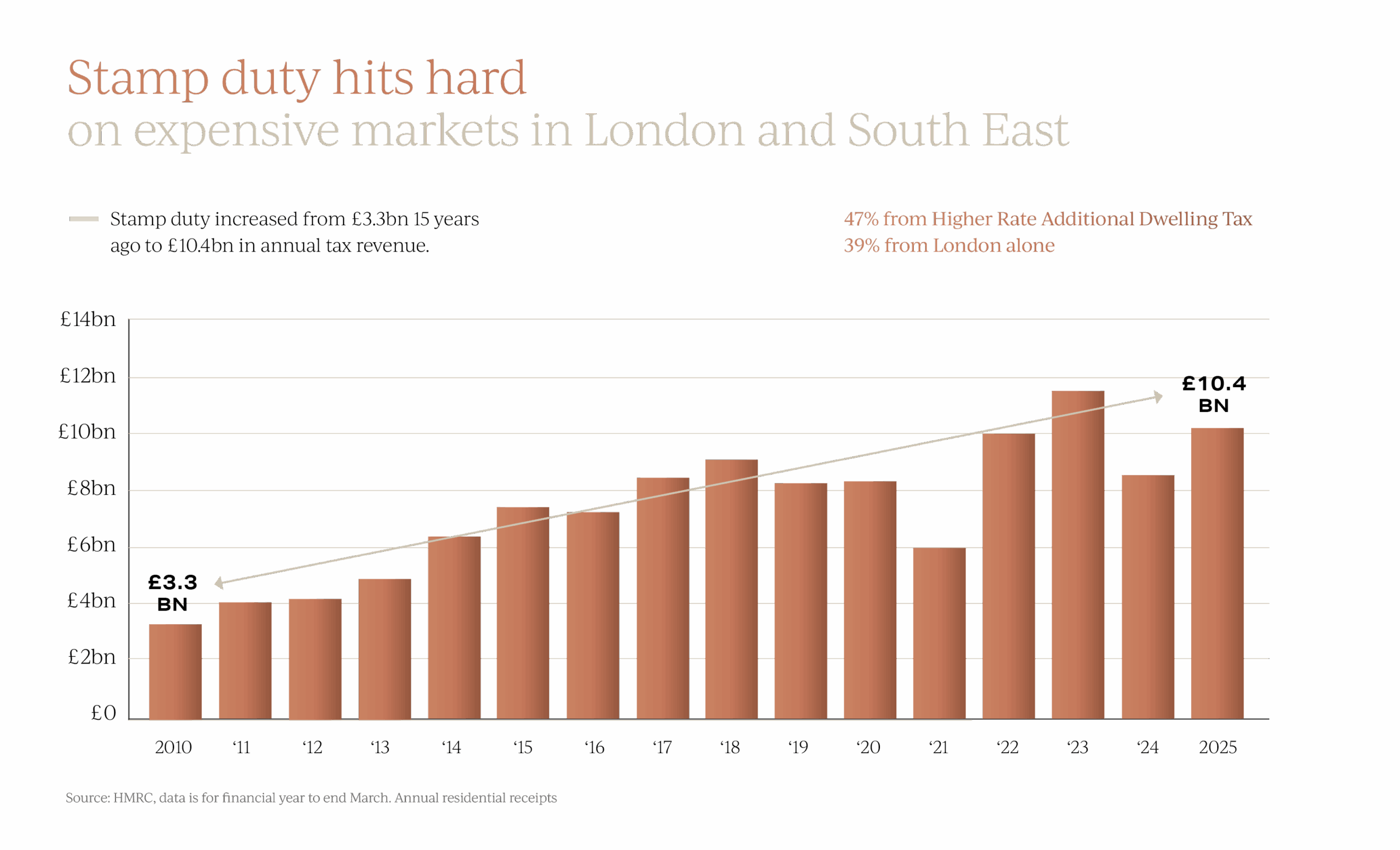

Many buyers hoped the Autumn Budget would finally bring changes to stamp duty, especially in London and the South East where the tax bites hardest. But the truth is that stamp duty has become far too important to the Treasury for anything major to happen this year.

Last year it raised £10.4 billion, up from £3.3 billion in 2010. London alone generates 39% of that total. And almost half of all receipts now come from the Higher Rate Additional Dwelling charge, the surcharge on second homes and investment properties.

Introduced at 3% in 2016 and lifted to 5% in the October 2024 Budget, it delivered £4.9 billion last year, or 47% of all stamp duty revenue.

Replacing such a revenue source with an annual property tax based on value would require a complete overhaul of England’s council tax system, itself a multi-year undertaking the government simply cannot accommodate. The result seems clear, stamp duty looks set to stay, and the current structure will remain a defining feature of the market for some years to come.

Autumn Budget confirms Mansion Tax

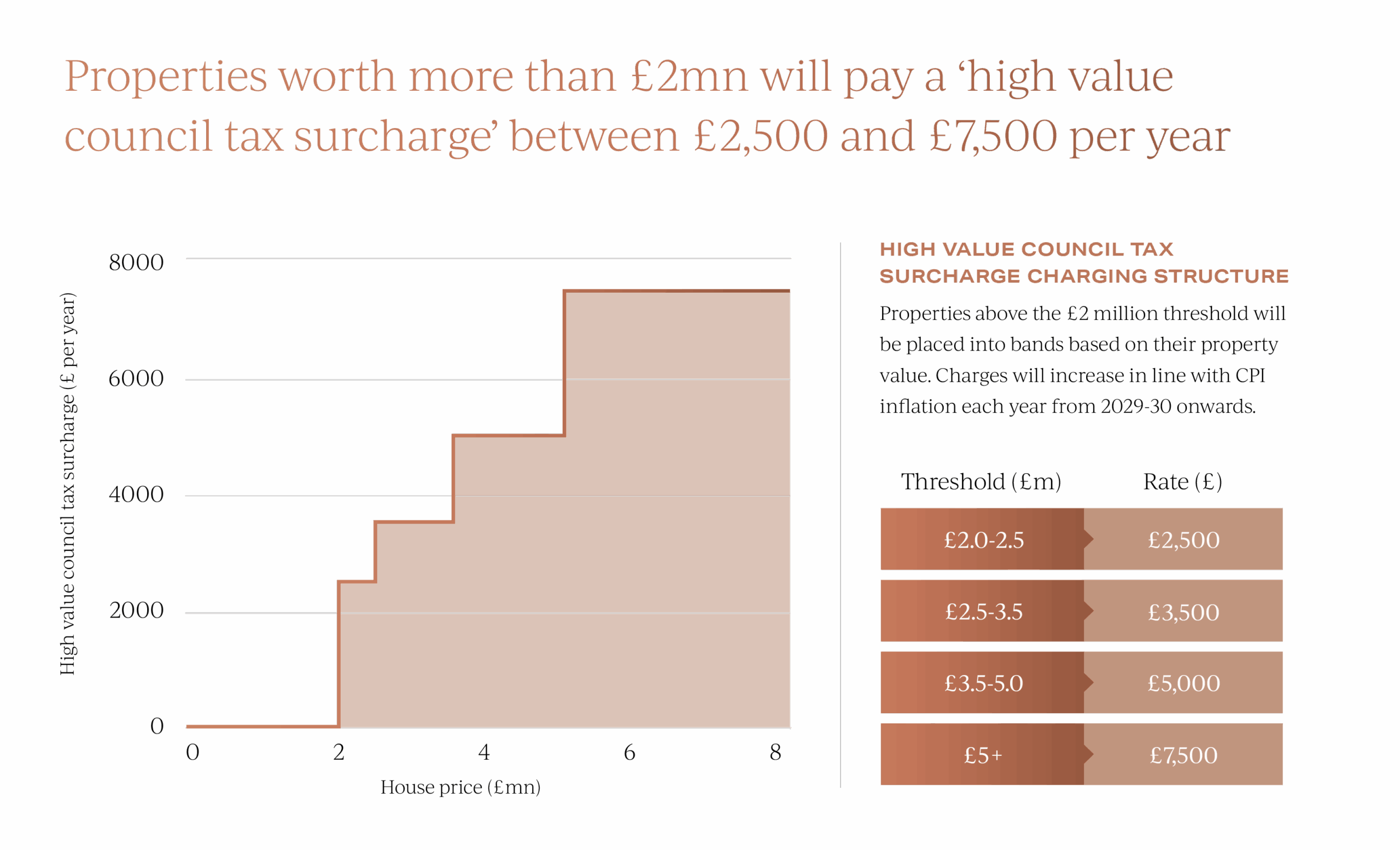

So, whilst SDLT remained unchanged, the Government did introduce a measure that reshapes the tax treatment of high-value property. Named the High Value Council Tax Surcharge, this ‘Mansion Tax’ is a new annual levy on homes assessed at £2 million or more that will take effect from April 2028 and applies only within England.

Property taxation is devolved, and neither Wales, Scotland nor Northern Ireland

have currently announced matching policies.

The structure is value-based rather than band-based. Under a 2026 revaluation, any English property above £2 million will fall into one of four valuation tiers, each attracting a fixed annual charge ranging from £2,500 to £7,500 a year.

Though modest in cash terms, the symbolism is considerable. For the first time, England is tying an annual charge directly to the market value of high-value property, which is something far closer to the systems used in other global markets.

England in global context

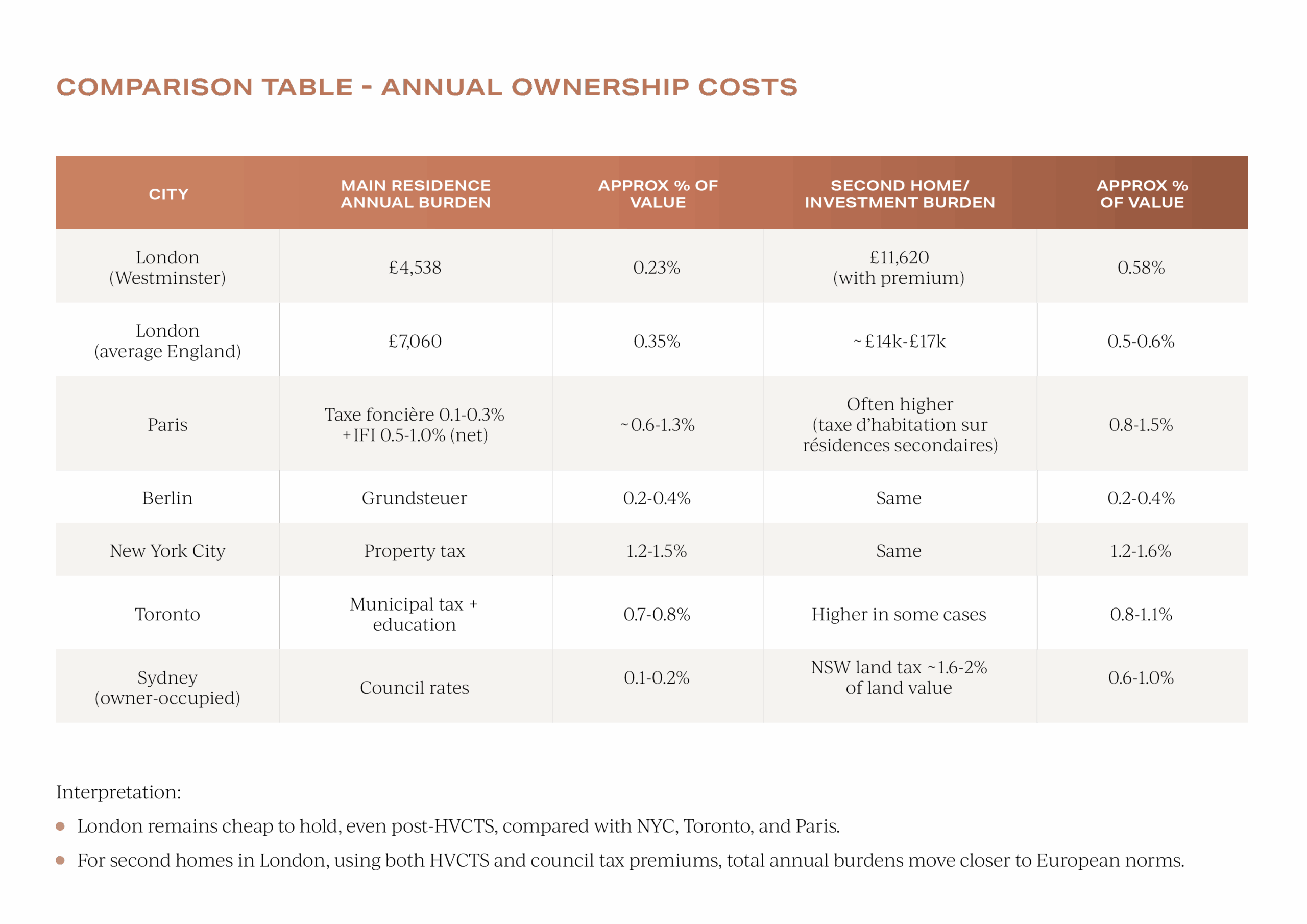

Set against other countries, England’s new surcharge barely shifts the overall balance. England has always been a high-entry, low-carry market, with stamp duty being heavy at the top end, but the ongoing cost of owning a £2 million or £5 million home has remained remarkably light in relative terms.

Even after the surcharge, annual charges on a prime London home amount to only a sliver of its value.

Compare that with New York, where yearly property taxes routinely top 1%, or Paris, where local taxes and the real-estate wealth tax make high-value ownership significantly more expensive. Toronto sits somewhere in between, but still well above England on recurring costs. This matters because London’s prime and super-prime sectors are dominated by globally mobile buyers. For them, tax efficiency is evaluated alongside lifestyle and liquidity. England remains expensive to enter, particularly for second homes, but comparatively cheap to own, being a key reason London continues to attract international capital.

This matters because London’s prime and super-prime sectors are dominated by globally mobile buyers. For them, tax efficiency is evaluated alongside lifestyle and liquidity. England remains expensive to enter, particularly for second homes, but comparatively cheap to own, being a key reason London continues to attract international capital.

Landlords under pressure

The Chancellor also confirmed that from April 2027, property income will be taxed at higher rates of 22%, 42% and 47% across England, Wales and Northern Ireland. The OBR expects this to raise around £0.5bn annually and forecasts a small pass-through into the market in the form of higher rents, a modest softening of house-price growth, and some contraction in rental supply.

For landlords, this compounds years of fiscal and legislative tightening with higher stamp duty on additional properties, reduced reliefs and more regulation.

Net yields are squeezed, and leveraged portfolios privately owned will feel the effects most acutely.

Emerging opportunities

Beneath the headline measures sit several targeted investments that could reshape specific local markets. Wales is the standout, with new AI Growth Zones, semiconductor funding, and continued momentum behind the Anglesey Freeport, all pointing towards stronger job creation and a higher-skilled workforce.

In England, Darlington is positioned as an emerging research hub, supported by a new STEM centre and RNA life sciences facility. London’s long-anticipated DLR extension to Thamesmead offers another catalyst, with improved connectivity often unlocking value in previously overlooked areas.

These pockets of investment don’t alter the national landscape overnight, but they do create clear focal points for buyers and investors willing to look ahead of the curve.

Moving with clarity

After a long period dominated by rumour and uncertainty, the market finally has the clarity it’s been waiting for. With the Chancellor’s decisions now confirmed, this gives anyone considering a purchase, or rethinking their wider property strategy, a far cleaner foundation on which to move forward.

If you’d like to explore how the changes made by the Autumn Budget might affect your own property plans, please do get in touch. Garrington’s advisers are on hand to offer informed, impartial guidance.

We will return before the end of the year with a fresh update on how these announcements are playing out in the market before the festive break.