The UK property market begins 2026 with renewed energy. Following the protracted uncertainty that clouded late 2025, last...

A Turning Point for UK Property as Buyers Look Ahead to 2026

As the year concludes, the UK property market is gradually regaining its composure after an autumn shaped by speculation, shifting expectations, and a distinct sense of waiting for answers.

The run up to the Budget created a prolonged pause in decision making, particularly in the higher value markets where policy risk is felt most acutely. Garrington has covered the key points from the budget already which, if you would like to watch, you can access via the following link: Budget Review.

Now that the detail is known, the atmosphere has subtly but unmistakably changed. Buyers are reassessing stalled plans, sellers are recalibrating expectations and the final weeks of the year are bringing a welcome return of clarity after months of conjecture.

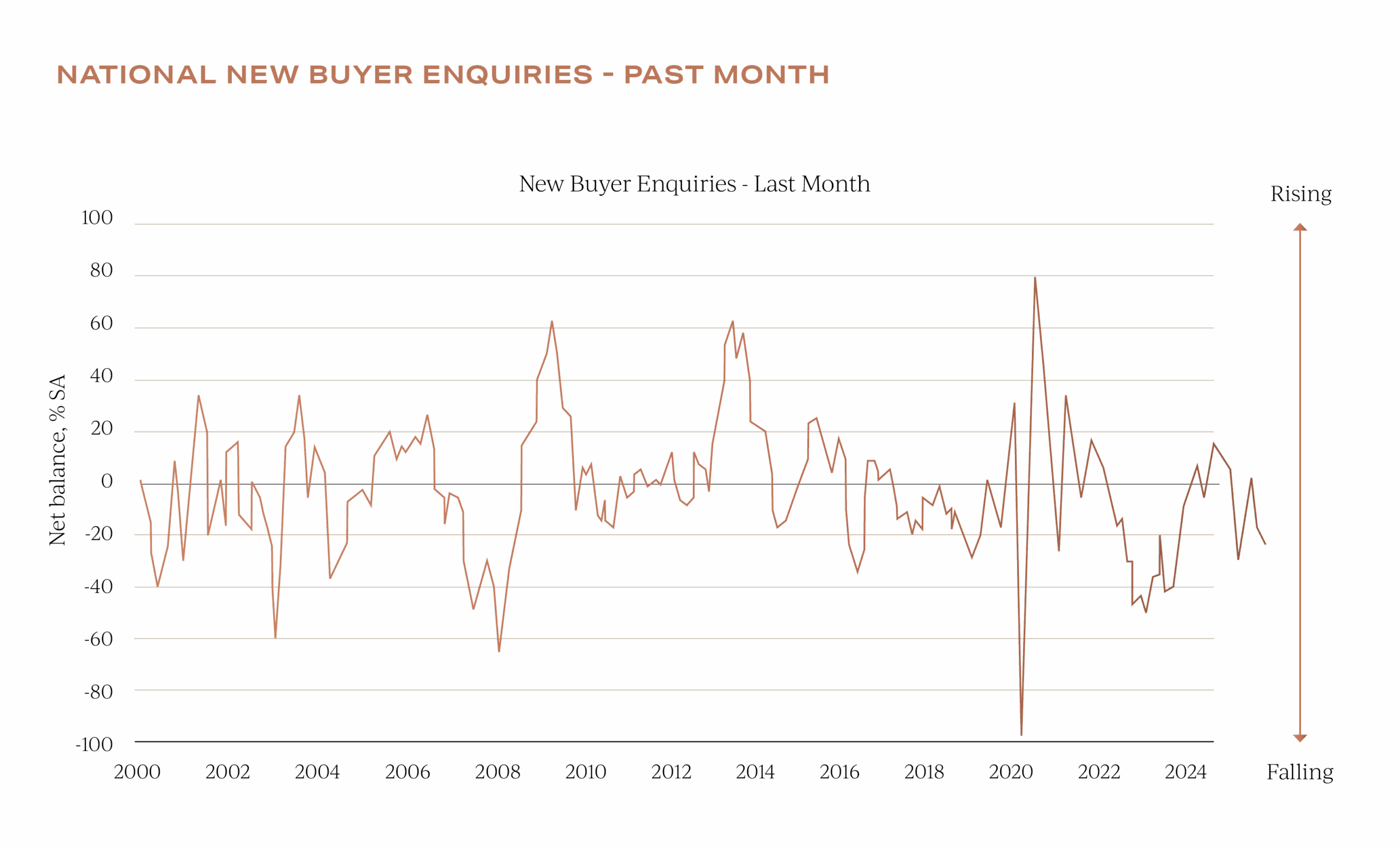

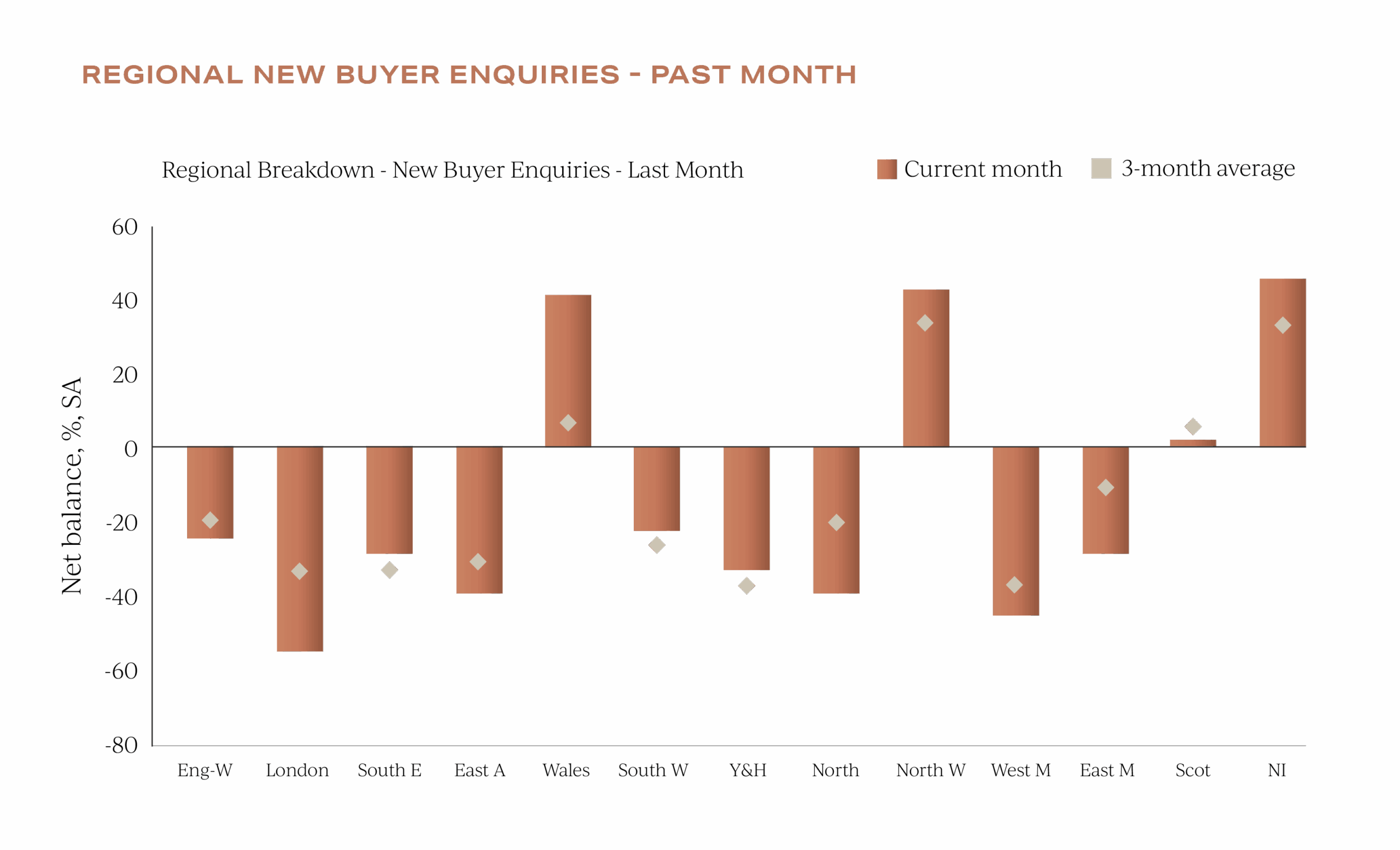

RICS survey data published last month captured the mood neatly, noting a marked decline in new buyer enquiries as political and economic uncertainty weighed on confidence.

Garrington’s own observations reflect that slowdown, although we have continued to see committed buyers progress carefully considered searches rather than abandoning moves entirely.

The past few months have been less about retreat and more about hesitation, and in property markets, hesitation rarely lasts.

Prime markets in a holding pattern

The prime and super-prime tiers have felt the effects of uncertainty more sharply than the mainstream.

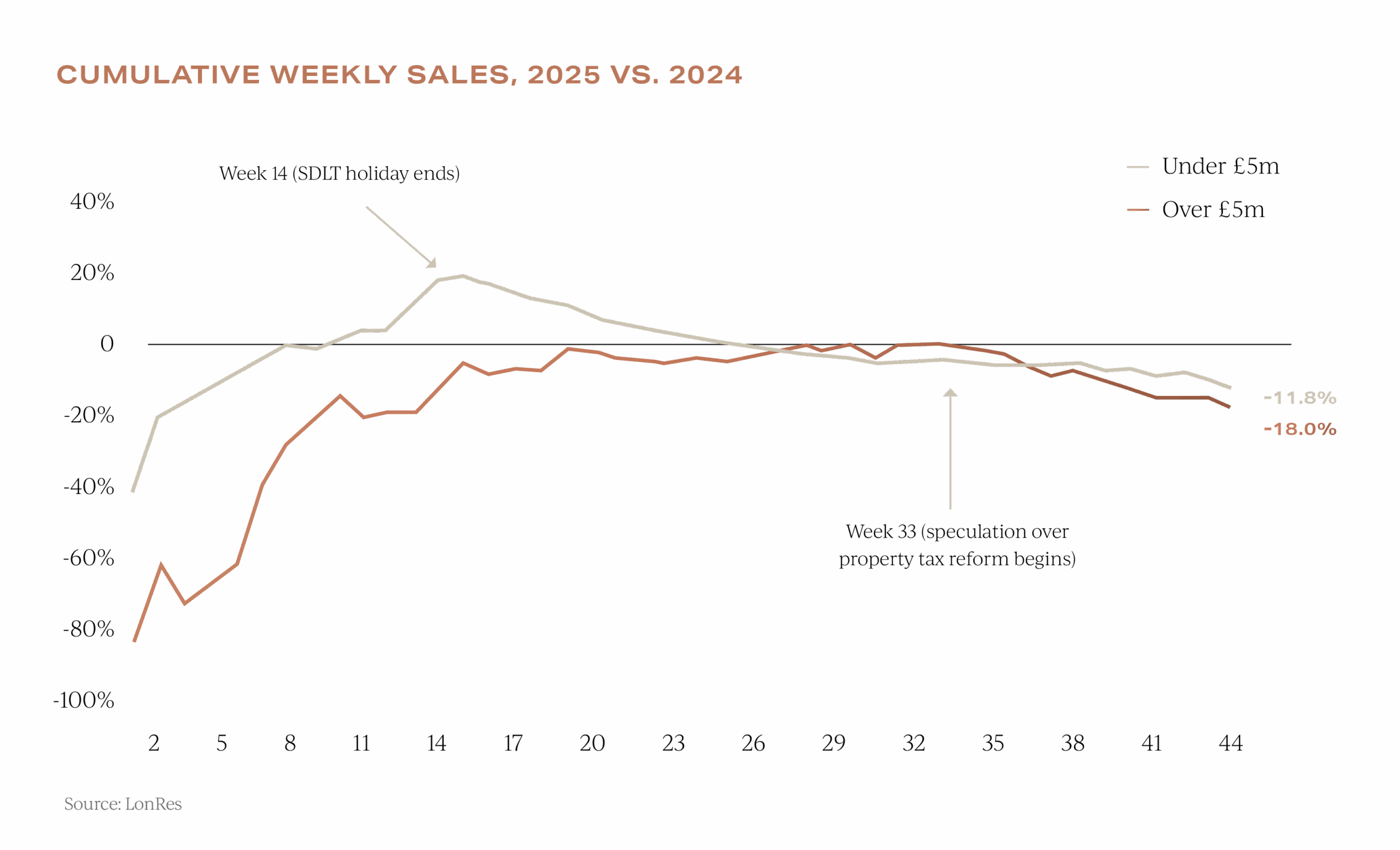

LonRes reports a material contraction in £5 million plus transactions over autumn, together with rising stock levels and an increase in price adjustments. These shifts are entirely consistent with a market dominated by discretionary buyers who prefer to pause rather than race ahead when policy change is on the horizon.

What has been notable is the split within prime city markets. Best in class homes, correctly presented and priced in line with current reality, continue to attract interest and achieve respectable results.

Properties with more ambitious pricing, or those requiring meaningful investment, have struggled to gain traction.

The country house market has shown a similar dynamic, with buyers widening search areas, favouring more flexible accommodation and scrutinising value more closely than in previous years.

Garrington has been working with clients who have used this climate to negotiate with greater confidence. For well briefed buyers, the past quarter has offered rare opportunities to secure quality assets on favourable terms, although that window may narrow as clarity and stability return following the budget.

UK property values settle

National house price movements in 2025 have been remarkably contained. The UK’s largest indices show minimal variation over the course of the year, with average values drifting only slightly from month to month.

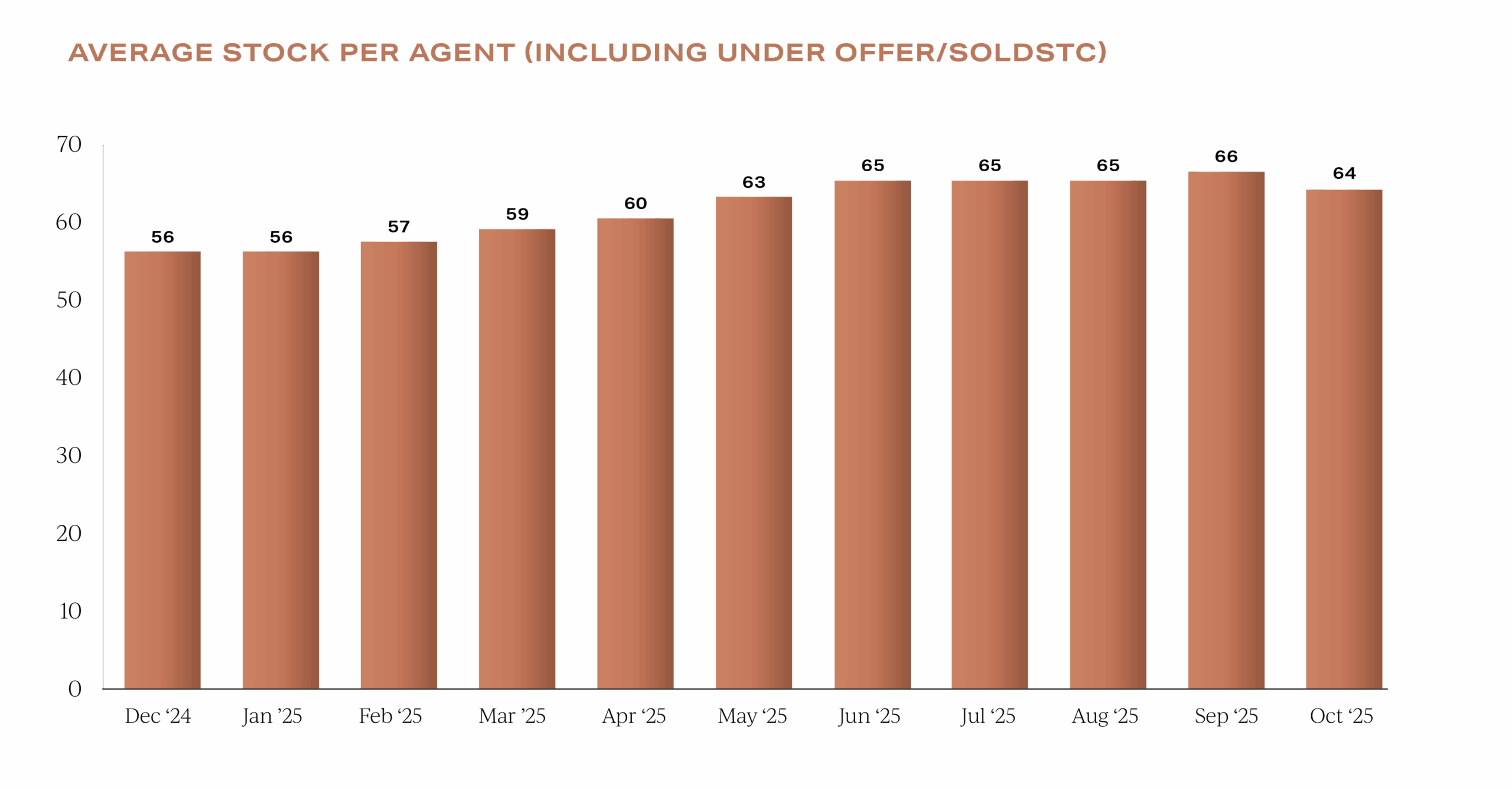

Rightmove has reported the highest number of homes for sale in more than a decade, which has placed natural downward pressure on asking prices in some regions. However, that rise in supply has not translated into widespread stress on values.

Industry forecasts for the year ahead expect growth to remain subdued in 2026 before strengthening as interest rates ease and the broader economy steadies. The UK property market is recalibrating to steadier, more rational price patterns and that process is far less dramatic than many were forecasting a year ago.

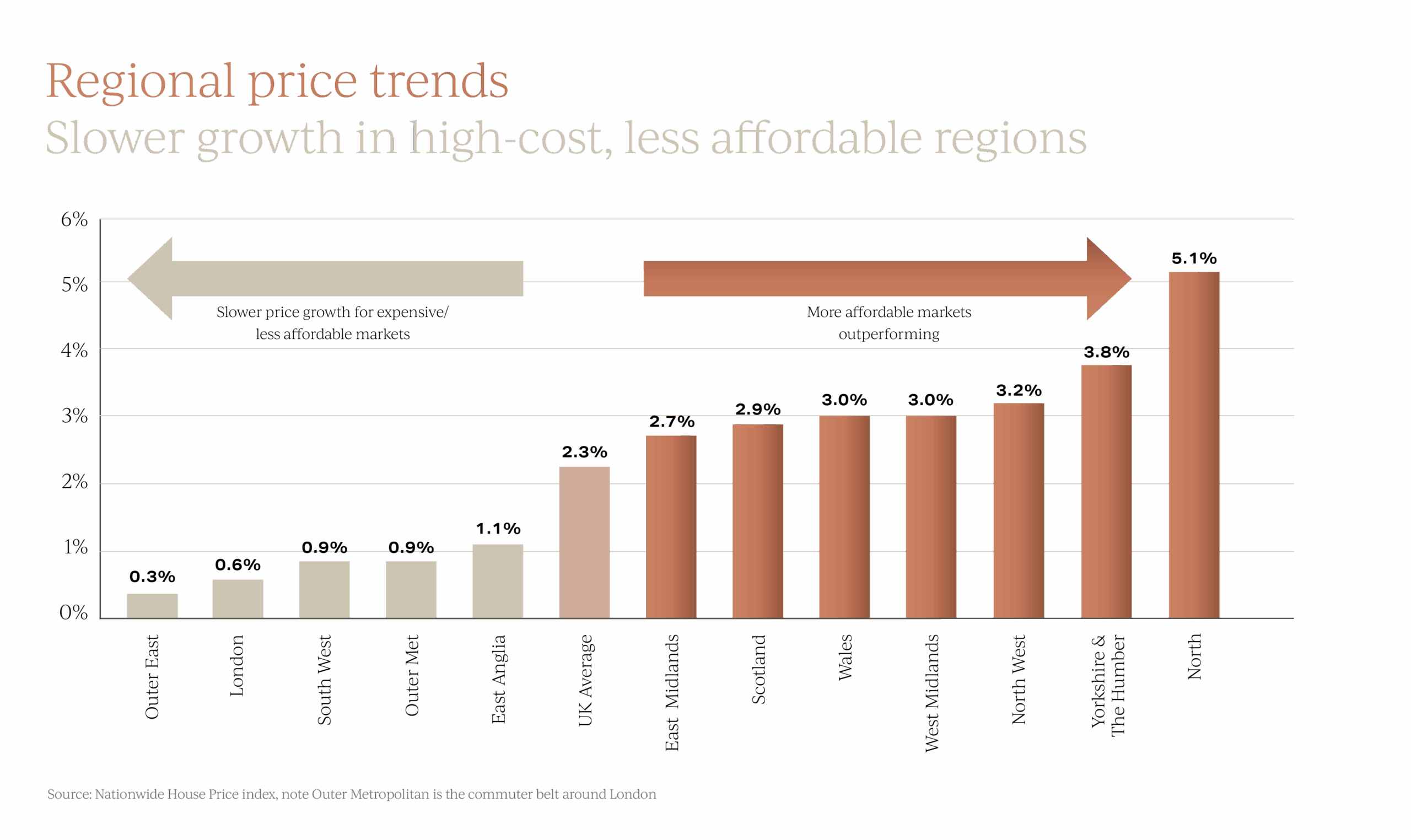

This is reflected regionally too. More affordable Northern and Midlands markets have outperformed, supported by stronger relative value and demographic momentum, while higher priced southern markets have been held back by supply and sentiment.

Garrington expects these regional divergences to continue into 2026, particularly while mortgage affordability remains a central influence on buyer behaviour.

What buyers want in 2026

Garrington’s client requirements throughout 2025 highlights three wider pronounced behavioural trends that are set to shape demand in 2026.

The first is the continued rise of multi-generational living. Families are prioritising homes that offer flexibility, privacy and interchangeable space, often through annexes, self-contained floors or outbuildings.

Economic pressures, childcare costs and evolving care needs have converged,

making adaptable accommodation a defining requirement for many.

The second is the growing premium attached to sustainability. Solar generation, battery storage, triple glazing and superior insulation have moved into the mainstream and are increasingly central to buyers’ shortlist criteria.

With future regulation likely to continue tightening and with energy prices still unpredictable, homes with strong environmental performance are now seen as defensive assets as well as lifestyle choices.

The third is the shift in perceived value. Buyers are reassessing where their budgets stretch furthest, looking beyond traditional hotspots and rediscovering well connected provincial towns, cathedral cities and high-quality commuter locations.

Lifestyle, space and long-term potential is outweighing legacy prestige in many purchasing decisions.

A clearer landscape for the UK property market in 2026

Looking into the new year, the UK property market appears poised for a period of quiet improvement.

We expect price movements in early 2026 to remain subdued, although confidence is already showing signs of returning. The prime sector is likely to regain momentum as international buyers re-engage and domestic purchasers feel more assured about the policy backdrop.

For buyers who have been biding their time, 2026 could offer a window where increased choice, improving affordability and a calmer economic setting align.

For those of you wondering where to start with a property purchase in 2026, Garrington has introduced a dedicated Property Advisory Service, designed for movers at the planning or research stage, whether exploring the best locations to live, assessing options, or seeking tactical advice on a property already identified.

We look forward to sharing our January insights with you in the New Year, but in the meantime, on behalf of all the Garrington team, we wish you a very happy festive season and successful 2026.