As the year concludes, the UK property market is gradually regaining its composure after an autumn shaped by speculation,...

UK Property Market Reawakens Amid Shifting Buyer Priorities

The UK property market begins 2026 with renewed energy.

Following the protracted uncertainty that clouded late 2025, last November’s Budget has provided a psychological reset for would-be movers. The fiscal measures may have landed lightly, but their significance lies in clearing the policy fog that had left the UK property market cautious and indecisive.

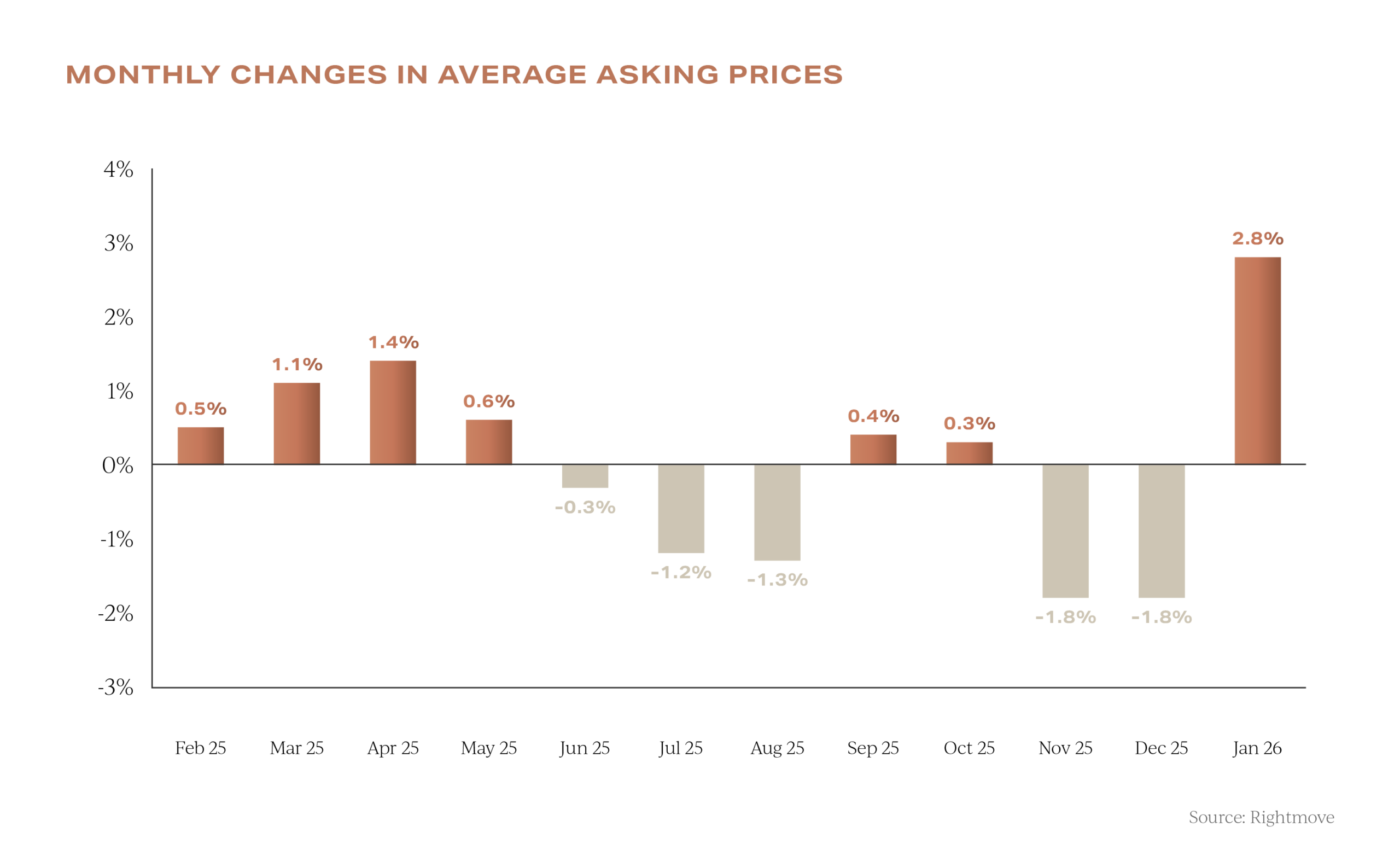

The response has been striking. Rightmove reported its busiest ever Boxing Day, with buyer demand surging 57% in the two weeks following Christmas, and average asking prices rising 2.8% in January, the largest jump for that month since 2015.

Garrington has seen corresponding upturns in enquiries and viewing activity across multiple geographies and price bands. Sales agents confirm a strong start to the year too, with increased viewing and valuation appointments, the clearest early indicator of the pipeline rebuilding.

Garrington has seen corresponding upturns in enquiries and viewing activity across multiple geographies and price bands. Sales agents confirm a strong start to the year too, with increased viewing and valuation appointments, the clearest early indicator of the pipeline rebuilding.

Yet momentum should not be confused with market reality. Sellers are returning bullish, emboldened by increased portal traffic and headline price growth. A third of all listings, however, are still undergoing reductions. In many segments, buyers remain firmly in control.

UK property stock builds, but sentiment outpaces certainty

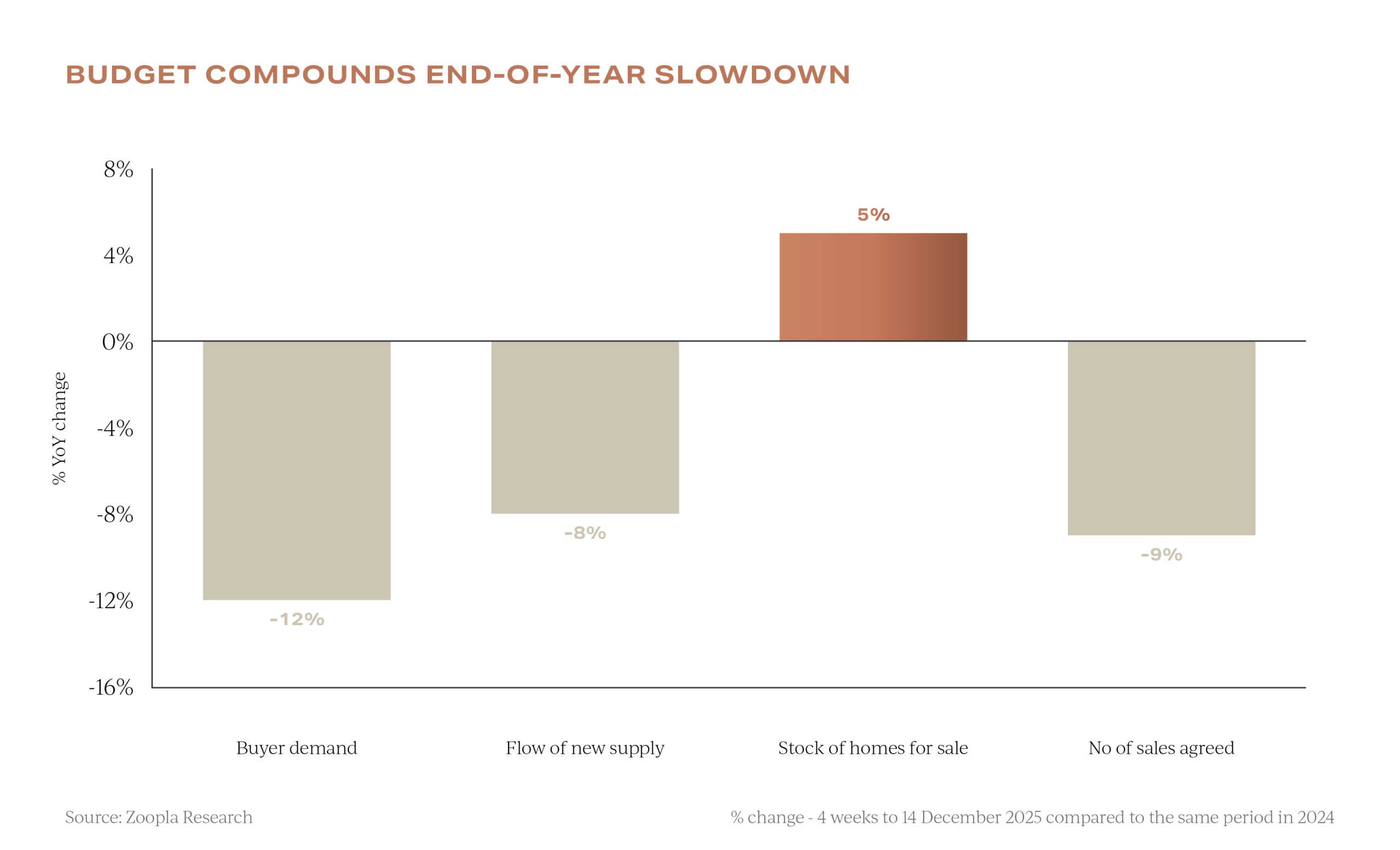

The supply side of the UK property market is awakening. Data from TwentyCi confirms a material rise in new listings, a continuation of the upward trend that began in late 2025. Garrington’s own observations show that many sellers are simultaneously preparing to become buyers, a dynamic that bodes well for liquidity and fluidity across price tiers.

Nonetheless, current purchaser demand is not yet keeping pace. The abundance of choice is allowing buyers to act with discernment and to negotiate assertively. Sellers expecting a return to pandemic-era pricing power are likely to be disappointed unless they adjust to market conditions quickly.

The current environment still favours the buyer, especially in areas where inventory is well stocked. Unless vendor expectations align more realistically with purchasing power, the early months of 2026 may see momentum in sales activity but limited price progression.

A tale of two halves? UK property forecasts for 2026

Forecasts for 2026 converge on modest gains, with Halifax, Hometrack and Nationwide all projecting house price growth in the range of 1% to 3%. These estimates reflect cautious optimism rooted in improving affordability rather than speculative exuberance.

So far this year, average house price movements have been relatively muted, with Nationwide reporting a 0.3% monthly rise in January and Halifax recording a 0.7% monthly increase, the fastest monthly gain in over a year, lifting the average Halifax-measured UK house price above £300,000 for the first time.

The average two-year fixed mortgage rate has declined to 4.29%, the lowest level since before the historical 2022 mini-Budget. For many home-movers, this equates to monthly savings. Wage inflation in several regions has quietly outpaced house price growth over the past two years, helping to recalibrate affordability ratios.

The average two-year fixed mortgage rate has declined to 4.29%, the lowest level since before the historical 2022 mini-Budget. For many home-movers, this equates to monthly savings. Wage inflation in several regions has quietly outpaced house price growth over the past two years, helping to recalibrate affordability ratios.

Yet headwinds remain. Inflation, though easing, has not fully abated. Unemployment is trending upward and geopolitical volatility is still casting a shadow. However, if borrowing costs fall further and economic sentiment continues to strengthen, transaction volumes could rise materially. In that case, price growth may well concentrate in Q3 and Q4.

The evolving profile of the active buyer

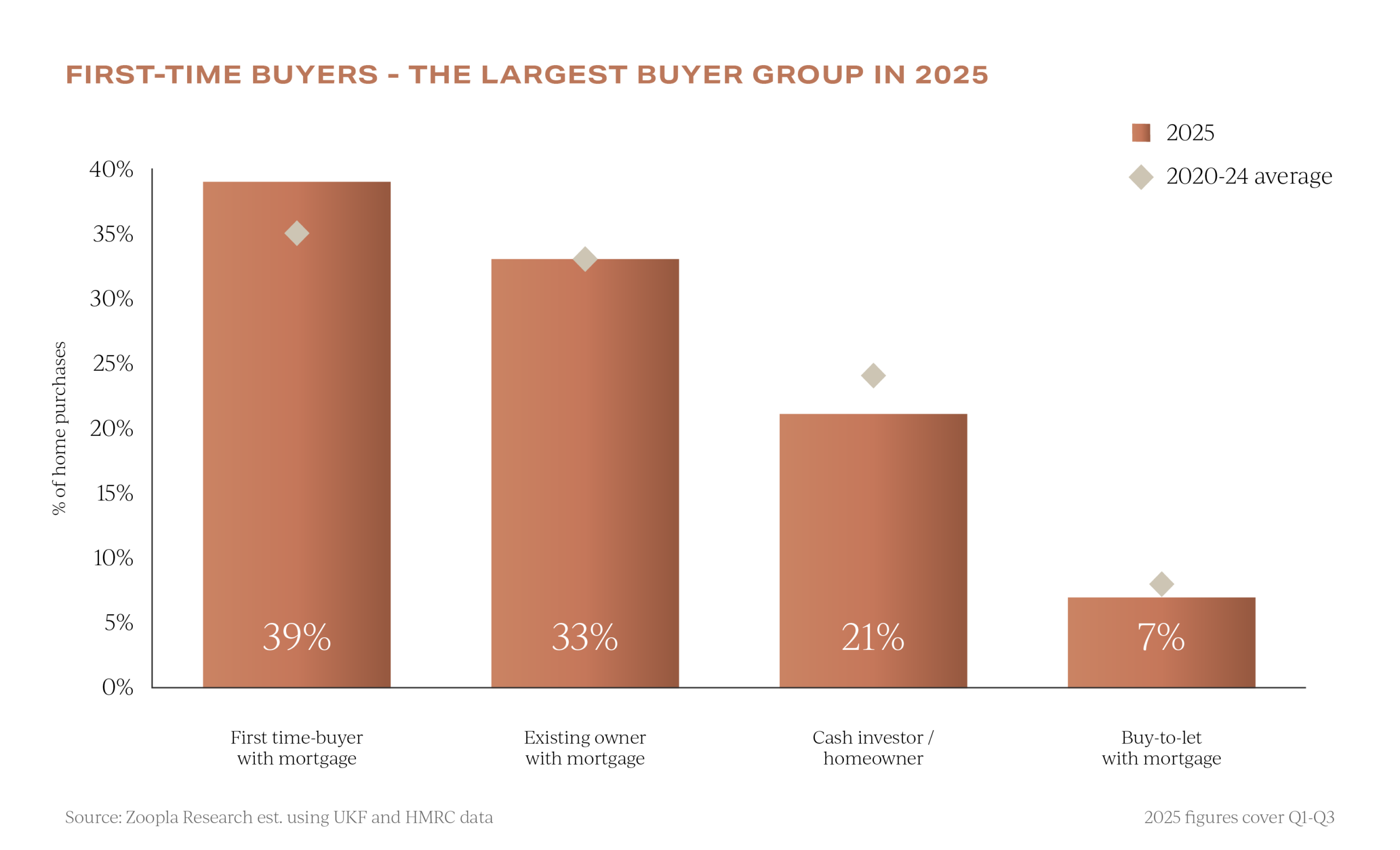

First-time buyers accounted for 39% of all transactions in 2025, an exceptional share, and look set to retain their primacy in 2026. Hometrack data suggests their presence will remain strongest in regional markets, where lower entry prices and improved mortgage accessibility make purchasing viable.

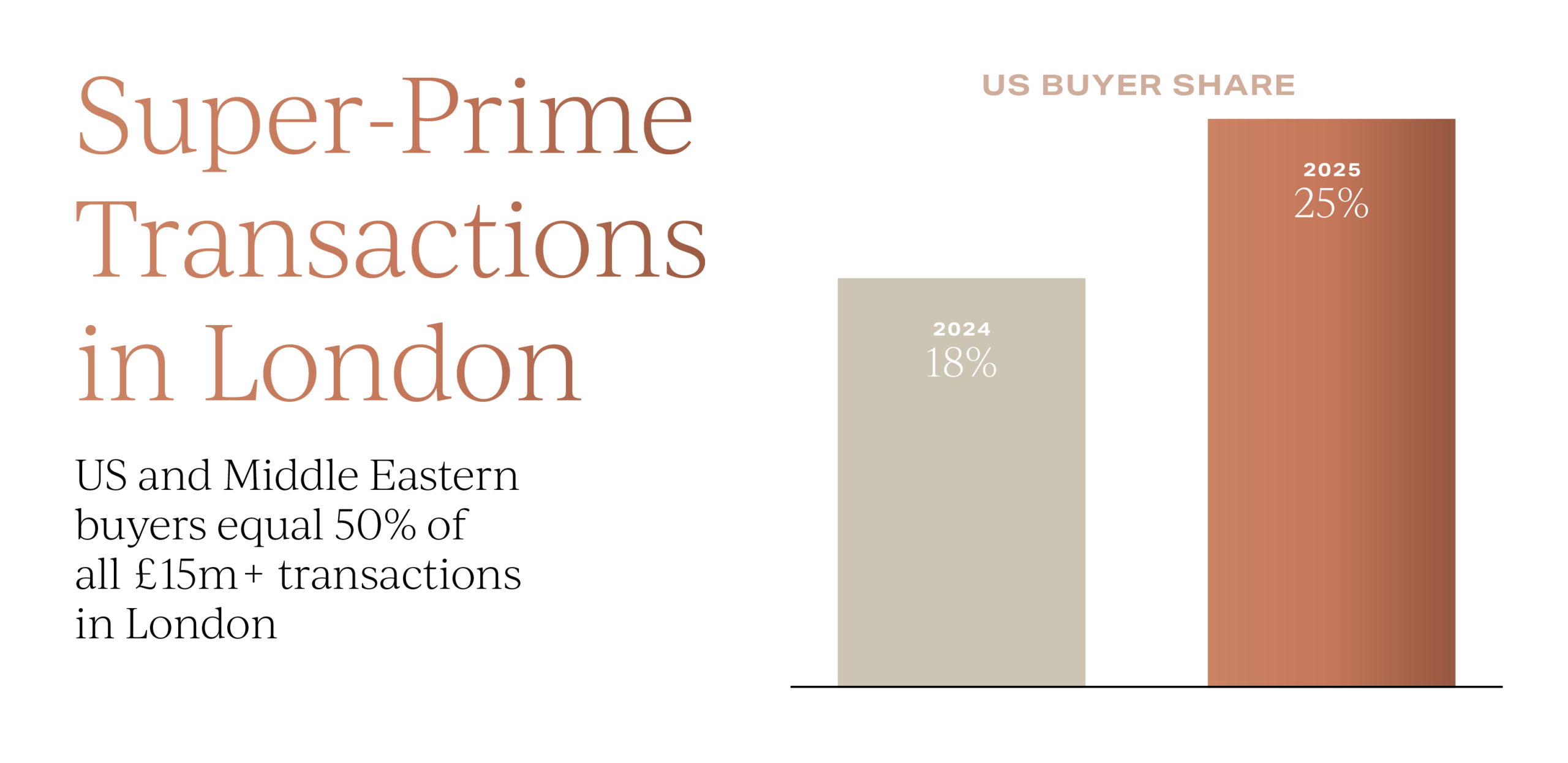

Garrington is witnessing a marked resurgence in international buyer activity. Industry research shows American purchasers now account for 25% of London’s super-prime transactions, up from 18% the previous year, making them the dominant foreign cohort. Combined with Middle Eastern buyers, these two groups represent half of all deals above £15m.

Garrington is witnessing a marked resurgence in international buyer activity. Industry research shows American purchasers now account for 25% of London’s super-prime transactions, up from 18% the previous year, making them the dominant foreign cohort. Combined with Middle Eastern buyers, these two groups represent half of all deals above £15m.

The shift reflects currency advantage alongside London’s enduring appeal as a safe haven. Rightmove data indicates enquiries from US house hunters jumped 20% in the first half of 2025, the strongest American interest in nearly a decade.

The shift reflects currency advantage alongside London’s enduring appeal as a safe haven. Rightmove data indicates enquiries from US house hunters jumped 20% in the first half of 2025, the strongest American interest in nearly a decade.

On the investor side, further change is coming. The Renters Reform Bill, set to take effect in May, could trigger further exits from the sector among smaller landlords. But institutional and sophisticated capital is moving in the opposite direction. Improving yields and softer values are reigniting interest in residential assets.

Region by region: affordability defines the opportunity

Affordability continues to shape regional performance. Northern Ireland posted a 6.7% increase in average house prices in 2025, maintaining its position as the UK’s top performer for the third consecutive year. Garrington has just launched in Northern Ireland, so do get in touch if you would like more detailed information on this market.

In a market where transaction volumes, but not prices, were generally down, the North West was the only region in which the £1m plus market outperformed its regional general market, reflecting the strong performance of the North West in our Best Places to Live ranking.

By contrast, southern England remains under pressure. Inner London markets continue to see price corrections, with achieved values in the £5m+ bracket falling 4% year-on-year and new listings down over 30%.

The volume of withdrawn stock has surged, and average discounts to asking prices now exceed 9%. Some outer boroughs, however, are faring better, supported by improved affordability and lifestyle-driven demand, and activity at lower price levels in London are noticeably more brisk.

Announcements to watch in 2026: policy, pricing and process

Several policy shifts merit close attention. The Chancellor’s Spring Forecast on 3rd March is not expected to bring material housing announcements, but any movement on the SDLT thresholds or planning reform could shift market psychology.

Scotland’s revised council tax bands, confirmed in last month’s Scottish Budget, may unsettle segments as buyers factor future liabilities into negotiations. A revised Energy Performance Certificate format, due in October 2026, could shape purchasing decisions, particularly for older housing stock.

Separately, the government’s consultation on streamlining transactions may trigger much needed reforms to speed up transaction times.

Help with your UK property search

For those at the early stages of planning a move this year, Garrington’s newly published Best Places to Live in 2026 research provides a valuable resource. The interactive tool allows users to compare locations across the UK based on a range of lifestyle and investment factors, helping buyers shape their thinking and refine their search.

Garrington continues to support buyers and investors navigating evolving conditions in the UK property market. For tailored advice or to discuss your 2026 property plans, please get in touch.