The UK property market begins 2026 with renewed energy. Following the protracted uncertainty that clouded late 2025, last...

UK Property Market Holds Steady, But Divides Deepen

Welcome to Garrington’s latest UK property market review.

As autumn sets in, the housing market is marked by sharp contrasts. Northern regions continue to outpace much of the South, while the mainstream market, sustained by first time buyers and families pressing ahead with moves, remains resilient. By comparison, discretionary purchaser activity is more subdued. In prime areas, headline figures mask significant variation, with some locations showing firm demand and others lagging behind.

Prices: Cooling but still climbing

The latest indices highlight contrasting short-term movements but a consistent underlying trend. Halifax reported a 0.3% rise in August, taking the average price to £299,331, up 2.2% annually. Nationwide showed a 0.1% monthly fall, with annual growth at 2.1%. Over the quarter, both measures align, confirming that while values are edging higher, the pace of growth has eased compared with the spring. Halifax also points to stronger growth in northern regions, particularly the North East, North West and Yorkshire and the Humber, while the South West is now showing a small annual decline. The overall picture is one of stability, with buyers and sellers adapting to a cooler summer market where realistic pricing is critical.

Halifax also points to stronger growth in northern regions, particularly the North East, North West and Yorkshire and the Humber, while the South West is now showing a small annual decline. The overall picture is one of stability, with buyers and sellers adapting to a cooler summer market where realistic pricing is critical.

Shifting expectations in the UK property market

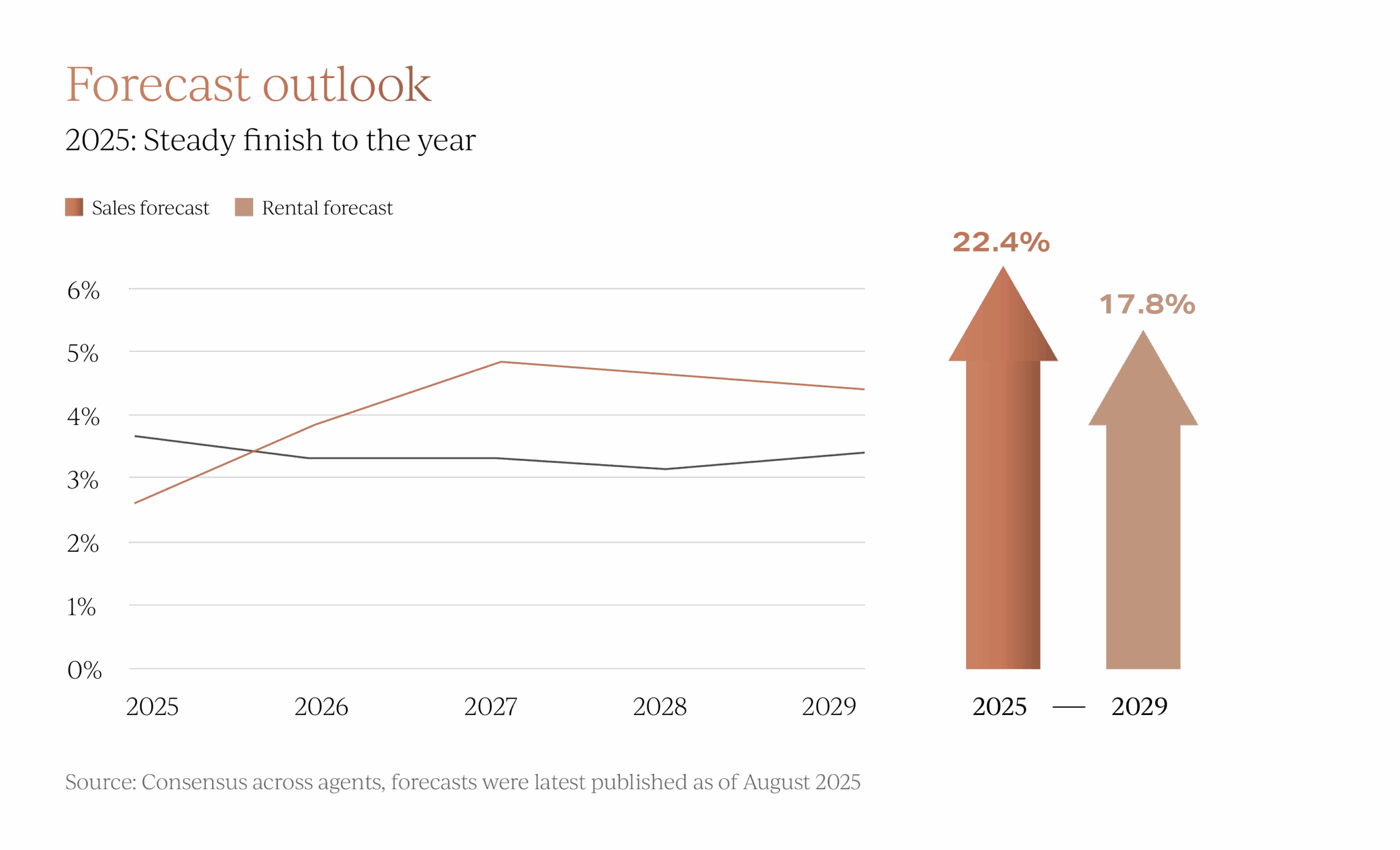

After various revisions over the summer, consensus forecasts now expect UK house prices to finish 2025 with around 2.7% growth, revised down from 3.3% at the start of the year. As can be seen here, the forecast visual shows expectations easing in the near term and improving thereafter. Growth is projected to strengthen to 4.0% in 2026, with cumulative gains of 22.4% by 2029.

The Autumn Statement on 26th November is likely to be pivotal to the validity of many of these forecasts. As noted last month, speculation has centred on possible inheritance tax changes and the prospect of stamp duty reform. No formal proposals have been confirmed, and significant reform would take time to legislate and implement. For now, the effect is mainly on sentiment, with some buyers delaying decisions until more detail is known and others taking advantage of the uncertainty.

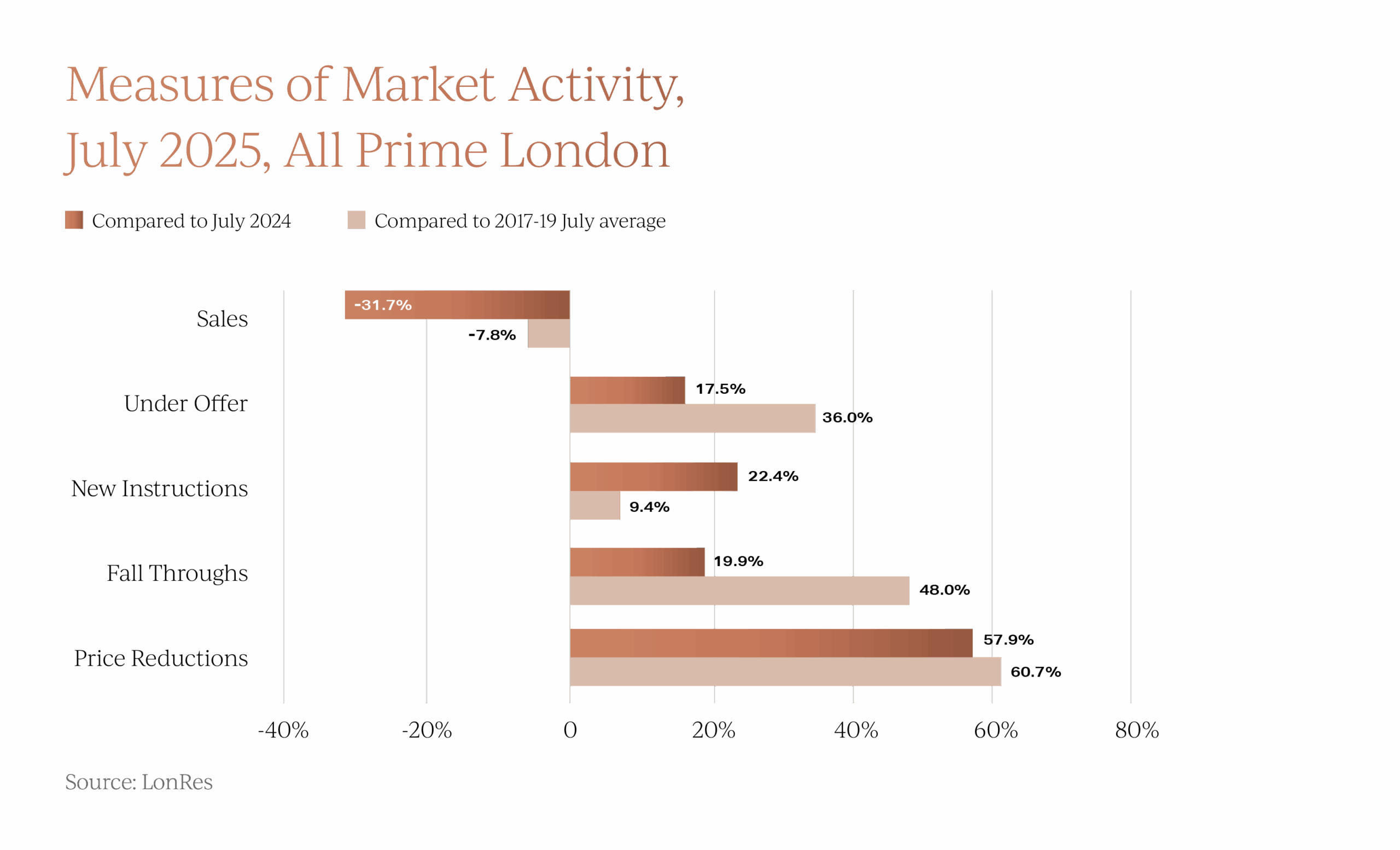

London beyond the headlines

Despite press coverage suggesting that London is struggling, the reality in the prime market is more nuanced. Latest LonRes data shows completed sales in July were 31.7% lower than a year ago for the same month, pointing to a summer slowdown. Yet the overall year-to-date picture remains firmer, with properties under offer still running 17.5% ahead of last year and 36% above the 2017–19 average for this stage in the calendar.

When deals are being done, they are typically at lower prices than this time last year. The latest data shows that 57.9% of properties in the prime London market have had their price adjusted, a sharp increase on last year.

For those unwilling to adapt to prevailing market conditions, unsold stock is increasingly moving into the rental market. This is being met by demand from some would-be buyers who, faced with uncertainty, are choosing to rent for the immediate term until there is greater clarity and potentially lower purchasing and borrowing costs.

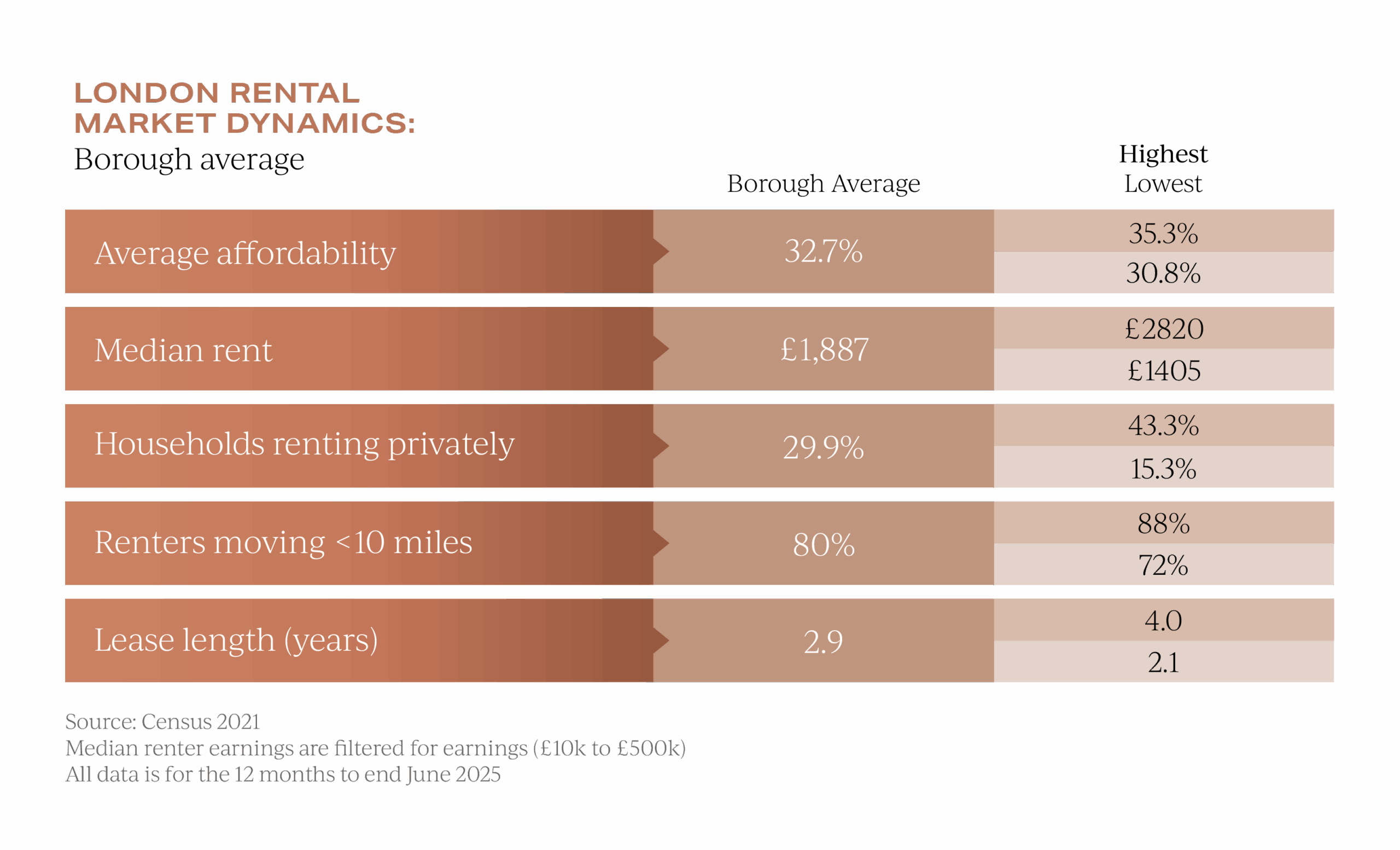

As can be seen below, the London rental dynamics chart sets this context. The share of households in the private rented sector varies from 15% in Bexley to 43% in Westminster, while most new lets are within a 10-mile radius and the average lease length is 2.9 years.

These figures highlight how the rental market is acting as a pressure valve for both buyers and sellers.

London cannot be read as one market; while certain districts continue to show resilience, others are progressing more cautiously.

Under one roof

One trend Garrington has seen gathering momentum over the past 12 months is different generations of the same family choosing to purchase a property together. Often described as multi-generational living, this approach is being driven by rising living costs, adult children staying at home for longer, and the practical need to care for older relatives.

Data from the ONS and Resolution Foundation confirms that the share of multi-adult households has been steadily increasing, while the English Housing Survey shows more families adapting properties to support shared living.

The fiscal backdrop is adding weight to this pattern. With inheritance tax thresholds frozen until 2029–30 and further reform under discussion, property choices are increasingly influenced by long-term tax planning. Garrington is seeing growing demand for properties with annexes, self-contained spaces, or flexible layouts, and this appetite could intensify if wider policy announcements in the Autumn Statement affect family wealth planning.

Autumn UK property market outlook

Market data remains steady, even as surveys point to caution. HMRC reported 95,580 transactions in July, up 4% year-on-year, while mortgage approvals for house purchases rose to 65,352 in July, the highest level in six months according to Bank of England data. RICS contributors noted softer purchaser enquiries, but deals are still progressing. Rightmove data underlines the divide; competitively priced homes are selling within a month, while overpriced stock lingers for more than three times as long.

The result is a two-speed market, split between those who ‘need to move’ and those who ‘want to move’. Buyers making essential moves, such as families purchasing their next home and first-time buyers, remain active. By contrast, discretionary purchasers, including buy-to-let investors, second-home buyers, and some parts of the prime UK property market, are slower to commit.

Looking ahead, the Autumn Statement could be defining. Fiscal changes may decide which parts of the UK property market might prosper and which could slow further. Garrington continues to help clients navigate these contrasts with confidence.

For anyone considering moving this autumn, Garrington’s Best Places to Live research provides a valuable starting point. The interactive tool allows users to compare locations across the UK based on a range of lifestyle and investment factors, helping buyers shape their thinking and refine their moving plans.

As ever, we’ll continue to track the market closely and share our insights in the months ahead and we look forward to updating you again soon.