Welcome to the March edition of Garrington’s Market Review, where we explore the latest shifts in the UK property...

UK Property News – August 2023

Welcome to the August 2023 edition of the market review from Garrington, where we share insights about the latest activity in the UK property market.

The traditional summer holiday lull is being felt across the market, as activity has slowed over the last month.

Despite this, recent economic events pose the question as to whether we have now reached a tipping point, as the direction of the Bank of England base rate and retail mortgage rates effectively decoupled last month.

In line with expectations, the Bank of England’s Monetary Policy Committee raised the base rate in early August to 5.25%, a figure not witnessed since April 2008. In contrast, numerous mortgage lenders have slashed their rates over recent weeks, possibly reassured by the decreasing inflation rate.

While this is not an immediate game-changer for the UK property market, it’s a positive sign for consumer confidence. If borrowing costs have peaked and may decline in the forthcoming months, it could breed renewed optimism.

Prices meandering

House prices have remained under tight scrutiny over the last month and all the latest house price indices paint a similar picture; of a market transitioning through a re-pricing phase driven by new levels of affordability and demand.

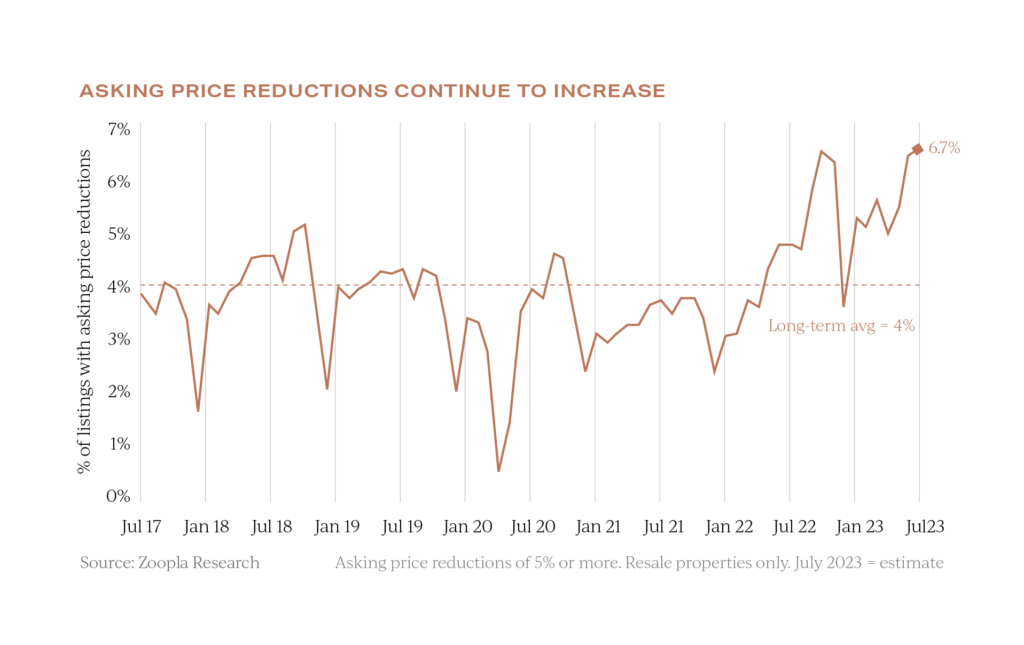

Data recording asking price reductions provides a useful forward indicator of what sales prices are likely to be doing for the rest of the year.

The UK’s two largest property portals both reported a rising trend of price reductions last month. Rightmove state that average asking prices of newly listed property for sale fell by 1.9% over the last month. This figure was exacerbated to a fall of 3.4% at the top of the market.

As can be seen below, Zoopla recorded that the amount of property listings where prices have been reduced by 5% now stands at 6.7% of all listings, which for context is 60% above the average rate seen over the last 5 years. The lowering of asking prices has the effect of lowering eventual sale prices, and as shown here.

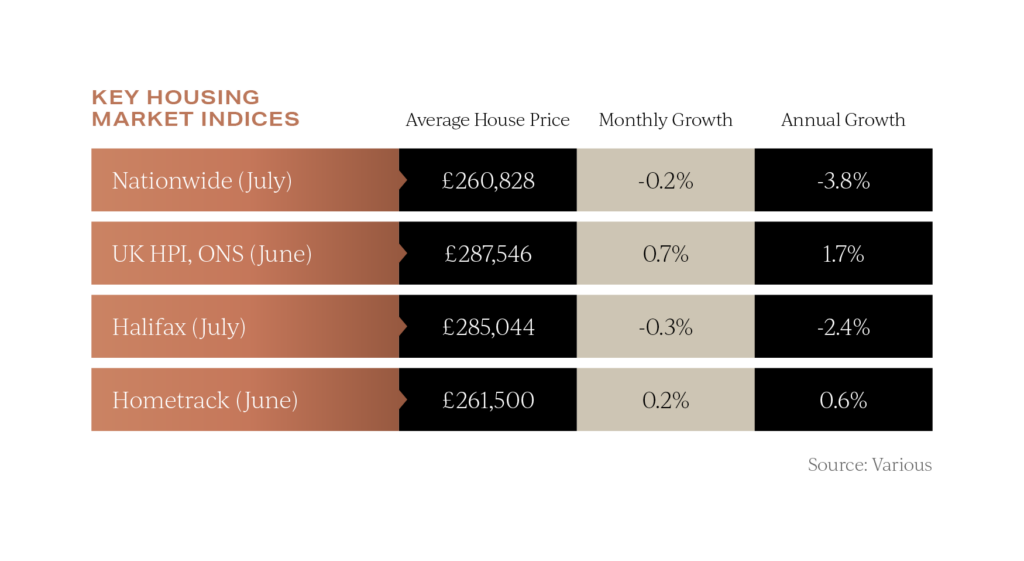

The lowering of asking prices has the effect of lowering eventual sale prices, and as shown here. Lenders Halifax and Nationwide both recorded month-on-month prices falls on average house prices last month. ONS, however, are reporting a rise, but due to a data lag in how they report, this goes back to June.

Lenders Halifax and Nationwide both recorded month-on-month prices falls on average house prices last month. ONS, however, are reporting a rise, but due to a data lag in how they report, this goes back to June.

Switching our attention to the prime London market, new research by LonRes reveals that the number of price reductions in the £5 million and above sector has so far doubled this year compared to the same months last year and across all price sectors the number of reductions is up by around a third.

Despite monthly fluctuations from different data sources, the overall picture is one of a downward trend and adjustment of prices rather than a temporary anomaly.

Market resilience

Despite the evident market rectification, there’s an emerging robustness.

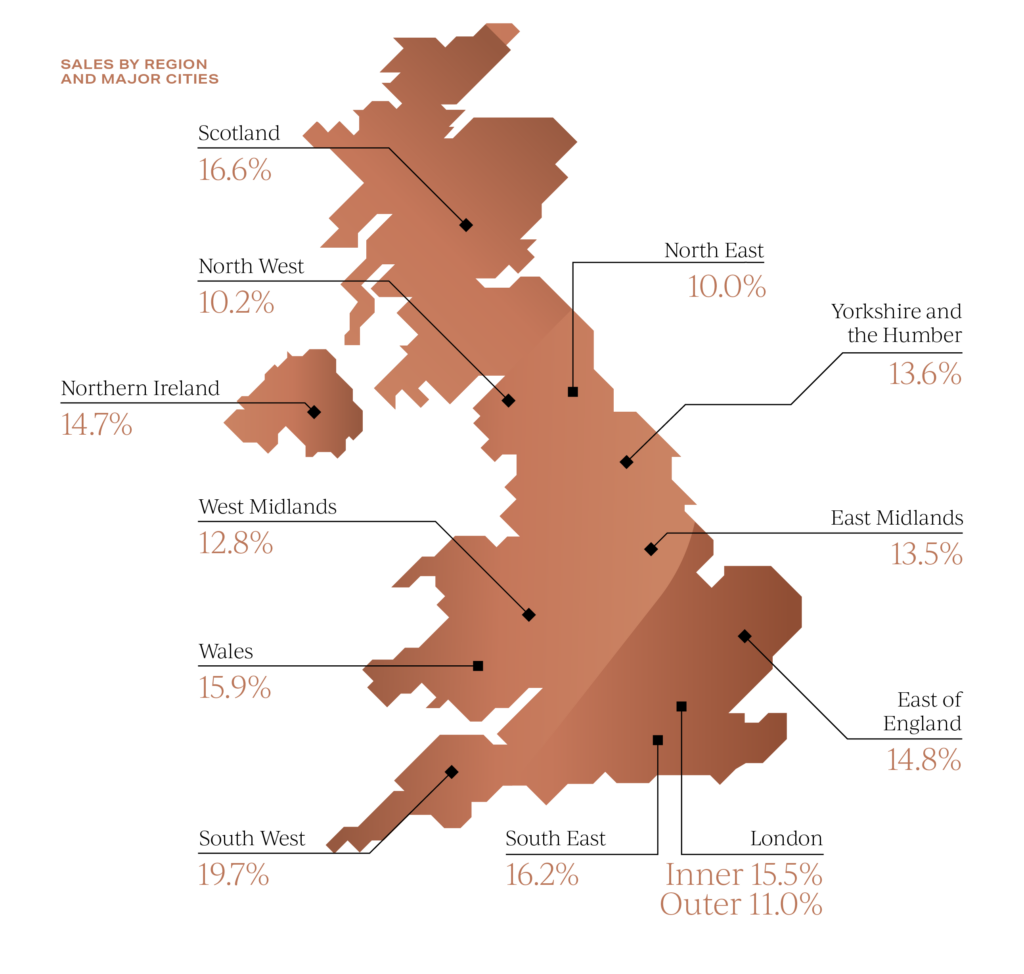

New research from TwentyCi records that despite significant headwinds in the market 68% of all properties listed for sale this year have successfully been sold.

Of note, property sales volumes increased by 14.5% in the second quarter of the year compared to the first, to 305,000 transactions.

As shown on the map below, different regions of the UK have seen different rates of growth with the south-west seeing the highest rate of sales growth.

Rightmove have also published new research last month assessing the strength of the market by location and reached similar conclusions to TwentyCi with regards to the south-west region.

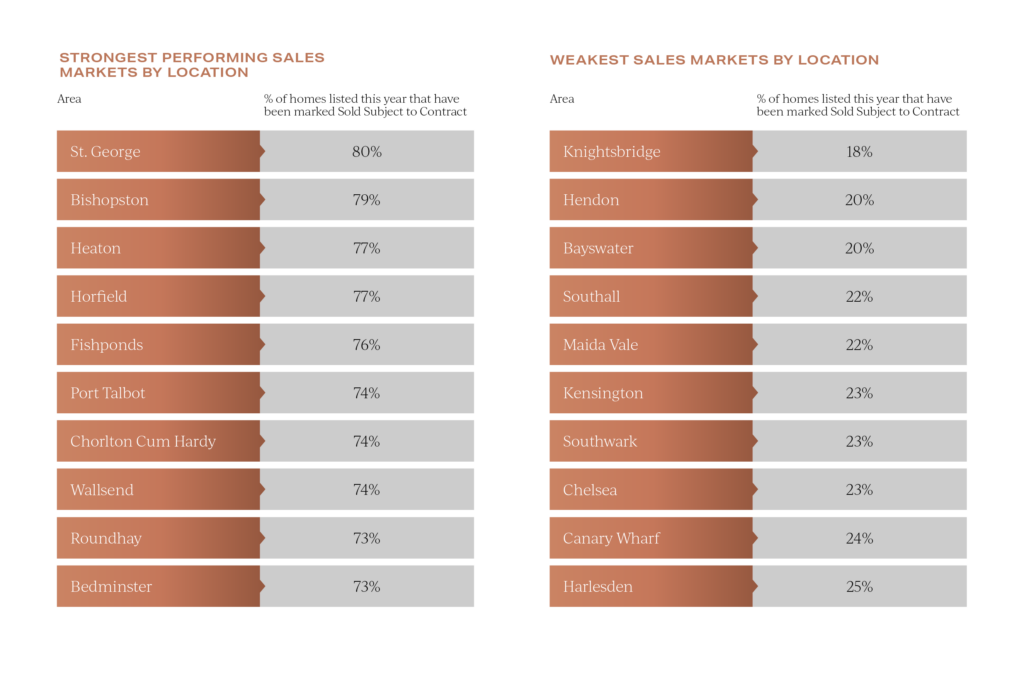

Rightmove have also published new research last month assessing the strength of the market by location and reached similar conclusions to TwentyCi with regards to the south-west region.

The top two slots in their ranking table of the strongest sellers’ markets were both in Bristol, with St George seeing 80% of homes for sale being marked as now sold. In contrast, Knightsbridge was reported as the weakest sellers’ market with just 18% of properties being listed for sale being sold. Higher value markets like Knightsbridge have been disproportionately affected by changing market dynamics. This has as much to do with the ownership profile of such markets as it does their values. Movers in these locations typically enjoy higher levels of equity and tend to be more discretionary based with their moving plans.

Higher value markets like Knightsbridge have been disproportionately affected by changing market dynamics. This has as much to do with the ownership profile of such markets as it does their values. Movers in these locations typically enjoy higher levels of equity and tend to be more discretionary based with their moving plans.

Outlook for UK property

The twists and turns of the market look set to continue to be influenced by multiple factors.

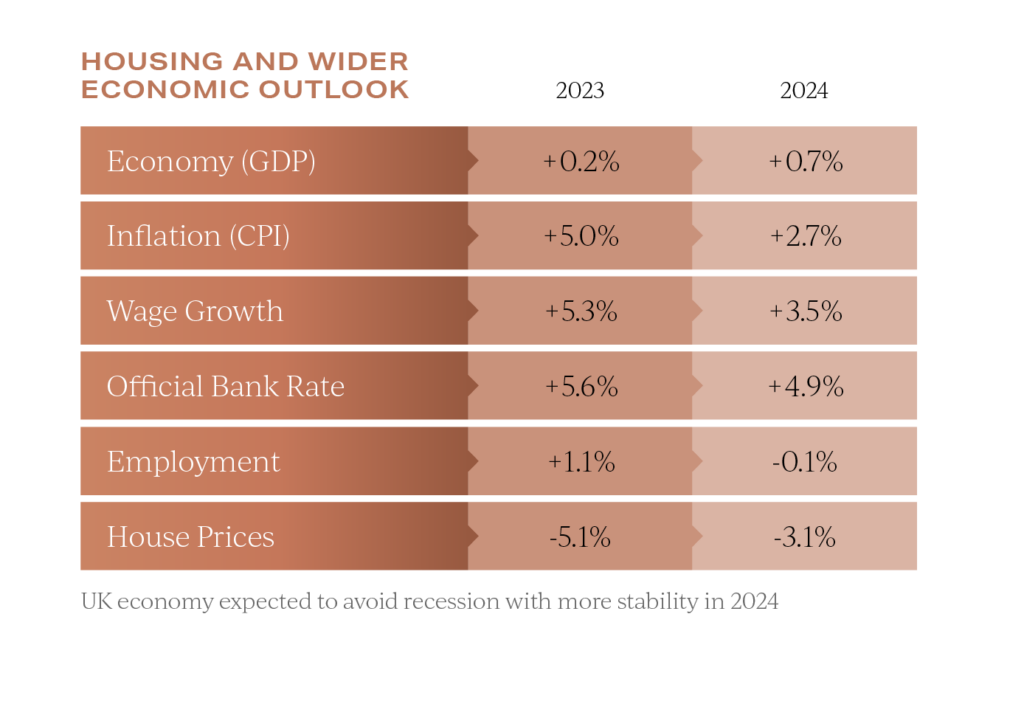

At face value, latest economic data and forecasts appear encouraging. The headline rate of inflation is falling and is predicted to be down to 2.7% in 2024. With wage inflation surpassing this figure, affordability might also start to improve. The forthcoming weeks will unveil whether the summer has swayed confidence and if we can anticipate a September surge in activity, coinciding with the commencement of the academic year and a return to regular routines.

The forthcoming weeks will unveil whether the summer has swayed confidence and if we can anticipate a September surge in activity, coinciding with the commencement of the academic year and a return to regular routines.

We will update on this topic and share further insights in next month’s report.

In the meantime, if we can assist you with your own property requirements anywhere in the UK, please do get in contact.