The UK property market begins 2026 with renewed energy. Following the protracted uncertainty that clouded late 2025, last...

Garrington UK Property Review: Global Capital Trends

Welcome to Garrington’s latest UK property market review.

In a change from our usual format, this month we are widening our focus. Alongside the latest domestic developments, we are also looking at international trends and how they may influence the UK property market in the months ahead.

Over the past month, the property market has settled into a calm but cautious rhythm. Prices are largely stable, and activity has slowed, particularly at the upper end, as buyers wait for clarity from the forthcoming Autumn Budget.

Speculation is growing around possible reforms to stamp duty, capital gains, and property taxation, prompting many high-value buyers to delay decisions.

At Garrington, we are seeing measured restraint among clients who are ready to act but keen to understand how the fiscal landscape might soon shift.

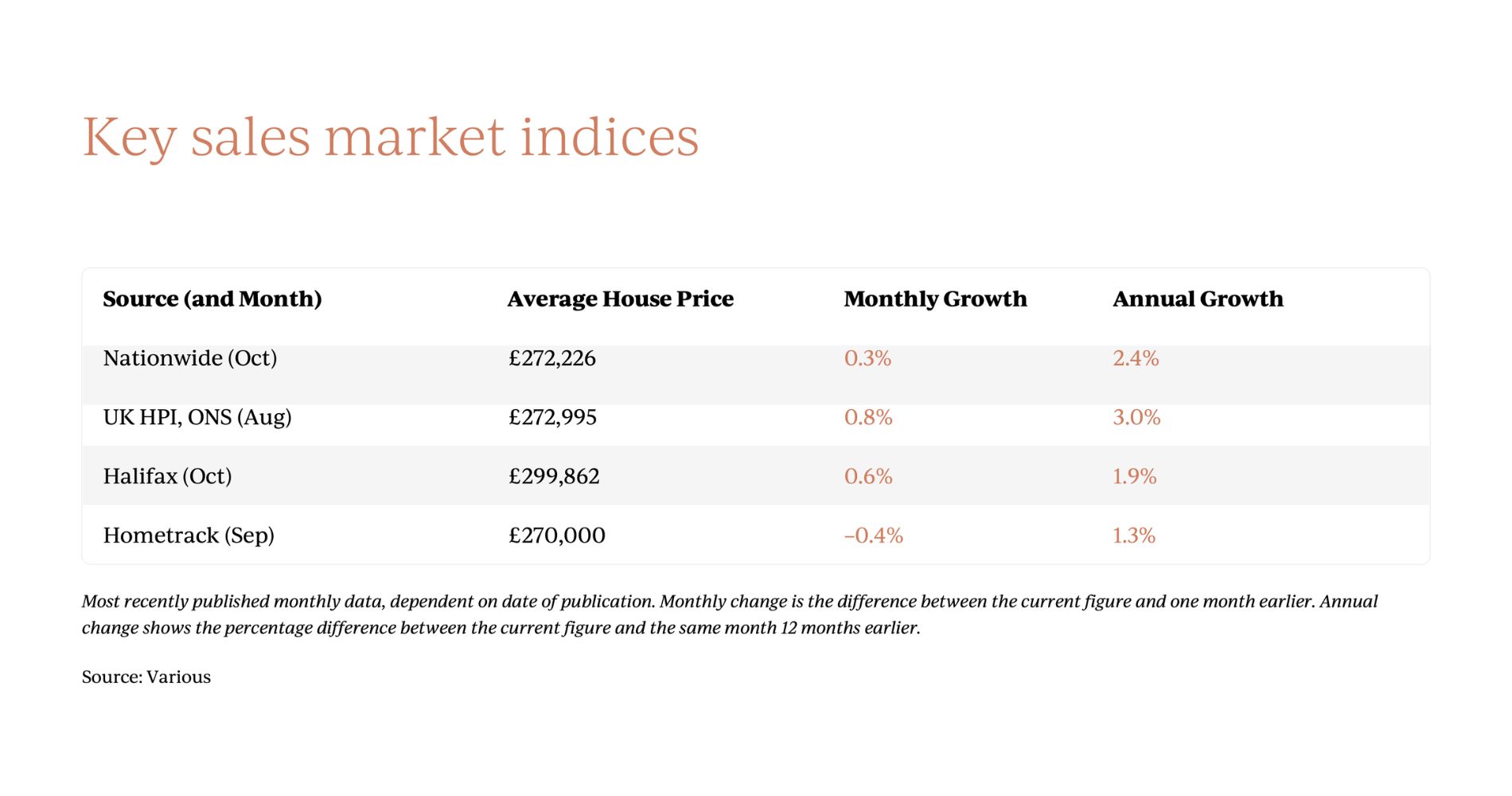

Nationwide reports a modest 0.3% monthly rise in average prices, with annual growth at 2.4%. Rightmove echoes this picture of stability, though buyer demand has slipped around 8% year on year, and agreed sales have recorded their first annual decline in two years. The slowdown is most pronounced in southern England, where higher-value markets are more sensitive to policy change. Yet this is not a distressed environment. Prices are holding, supply is improving, and motivated buyers remain active.

The slowdown is most pronounced in southern England, where higher-value markets are more sensitive to policy change. Yet this is not a distressed environment. Prices are holding, supply is improving, and motivated buyers remain active.

Hometrack estimates that more than 350,000 homes, worth over £100 billion, are currently progressing through to completion, clear evidence that the market continues to function, even if momentum has eased.

Rather than reigniting activity, the Autumn Budget is more likely to reshape it, creating challenges for some buyers and opportunity for others.

A Global Perspective on Wealth and Property Demand

Against the backdrop of domestic uncertainty and global volatility, Garrington has partnered with REALM, the international collective of leading property advisers, and Wealth-X Altrata, the global authority on private wealth intelligence.

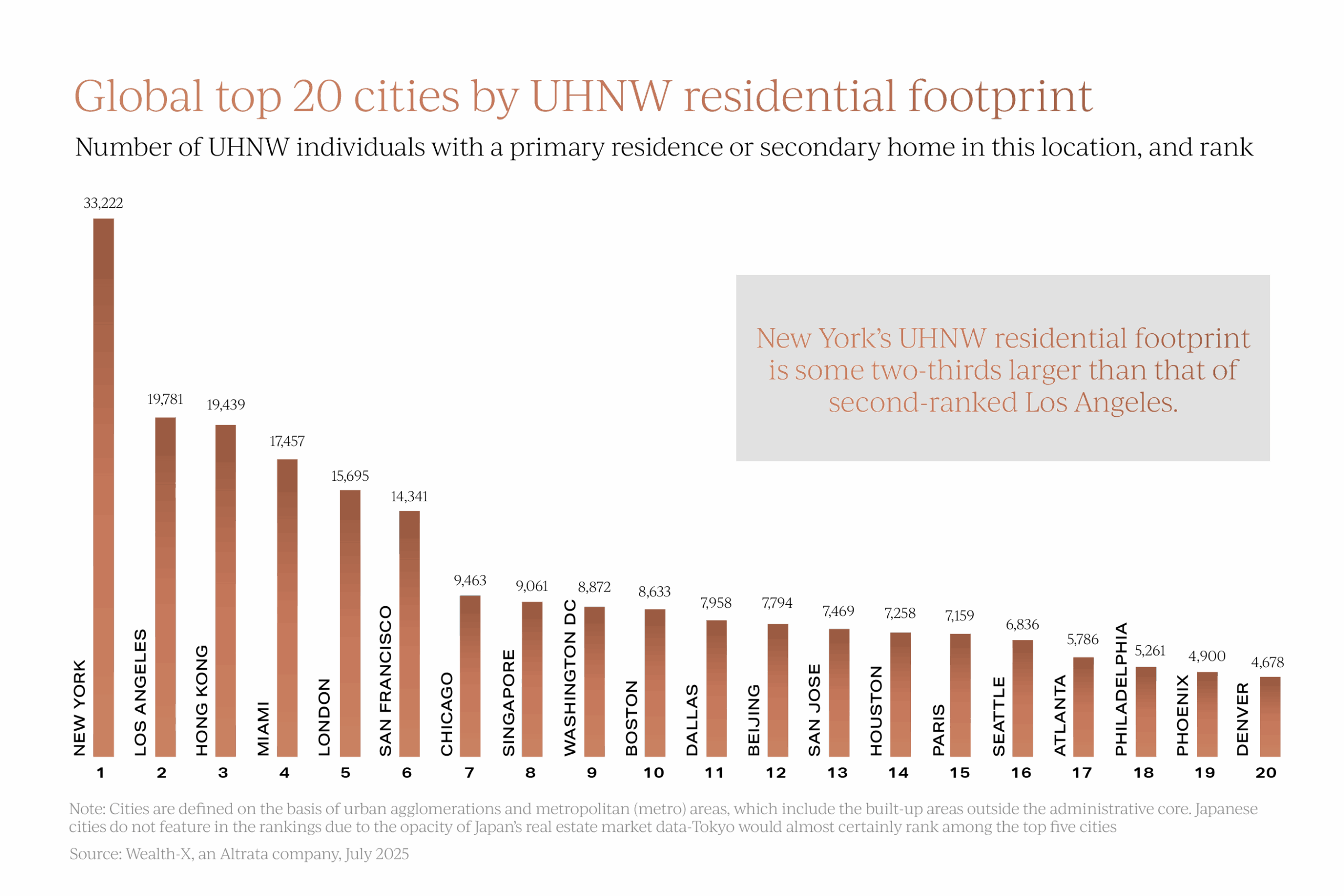

Together we have examined how and where the world’s 480,000 ultra-wealthy individuals, each with assets exceeding $30 million, are choosing to live and invest. The findings highlight clear behavioural shifts that are already influencing demand for prime UK property.

The findings highlight clear behavioural shifts that are already influencing demand for prime UK property.

Wealth without borders

Today’s wealthy are more mobile and internationally connected than ever before. Around 17% own or part-own a business headquartered outside their home country, and 14% have studied abroad at leading universities.

On average, each individual owns three homes across multiple continents. These are not just holiday retreats; they are strategic bases that support business, family, and lifestyle needs.

Capital now moves to where opportunity, safety, and quality of life come together.

For prime buyers in Britain, this means the competition is increasingly not purely domestic. They are now contending with international capital that thinks in currencies, not countries.

London’s global standing

Despite headlines about wealth departing the UK, London remains one of the world’s pre-eminent centres of private wealth. It ranks fifth globally for ultra-wealthy homeownership, behind New York, Los Angeles, Hong Kong, and Miami. It is also one of only two European cities in the global top twenty, alongside Paris. That position is hard-earned. London’s combination of legal certainty, education, culture, and connectivity keeps it resilient even amid fiscal debate and political change.

That position is hard-earned. London’s combination of legal certainty, education, culture, and connectivity keeps it resilient even amid fiscal debate and political change.

However, the global hierarchy may be shifting. New York, for a long time the world’s largest hub of wealthy homeowners, is already seeing capital drift.

Proposed policy changes under New York’s new city administration have prompted early signs of a ‘flight of equity’, with some investors diversifying holdings overseas. It is a reminder that political change can redirect wealth as sharply as economics.

The second-home phenomenon

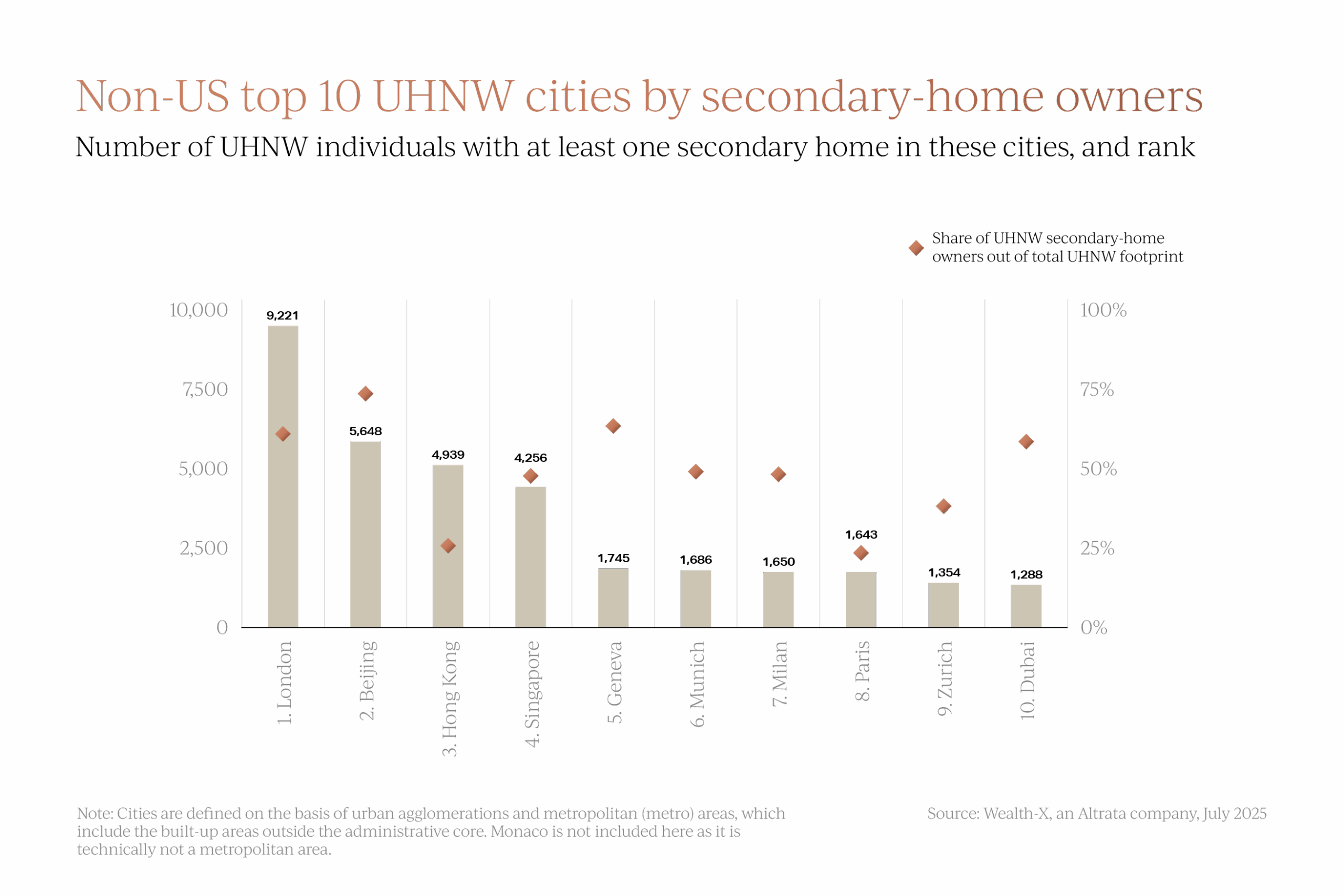

The rise of secondary residences continues to shape the luxury property landscape.

Miami now leads the world with over 13,000 ultra-wealthy second-home owners, fuelled by lifestyle appeal and low taxation. London sits just behind as the leading non-US second-home destination, with more than 9,000 secondary homeowners, accounting for nearly 60% of its total ultra-wealthy footprint. These properties are not always lived in year-round. For many, they are family bases, education hubs, or secure investments in a stable jurisdiction. This layer of international ownership underpins the capital’s long-term resilience, particularly in prime postcodes.

These properties are not always lived in year-round. For many, they are family bases, education hubs, or secure investments in a stable jurisdiction. This layer of international ownership underpins the capital’s long-term resilience, particularly in prime postcodes.

Currency and its influence

Foreign exchange movements have become one of the most significant market forces.

At the time of preparing this report, the pound had a difficult October, with that weakness continuing into November. Sterling fell to its lowest level against the euro in over two years, and sterling-dollar rates were at their weakest for around six months.

So, what does this mean in practical terms?

For a Euro-based buyer, every £1,000,000 spent on property now costs around €15,000 (1.3%) less than at the October highs, or over €75,000 (6.5%) less than at the start of the year. For a US dollar-based buyer, the same £1,000,000 spent on property is about $37,000 (2.8%) cheaper than in October, and roughly $60,000 less than just two months ago. Currency fluctuates constantly, but at the time of compiling this review, the advantage is clear. Buyers exchanging into pounds are finding their budgets go further, while those selling in sterling to fund moves abroad are seeing their proceeds stretch less.

Currency fluctuates constantly, but at the time of compiling this review, the advantage is clear. Buyers exchanging into pounds are finding their budgets go further, while those selling in sterling to fund moves abroad are seeing their proceeds stretch less.

In simple terms, current FX conditions are creating a window of opportunity for inbound investment, particularly from euro and dollar-based clients whose buying power has quietly strengthened.

The road to 2030

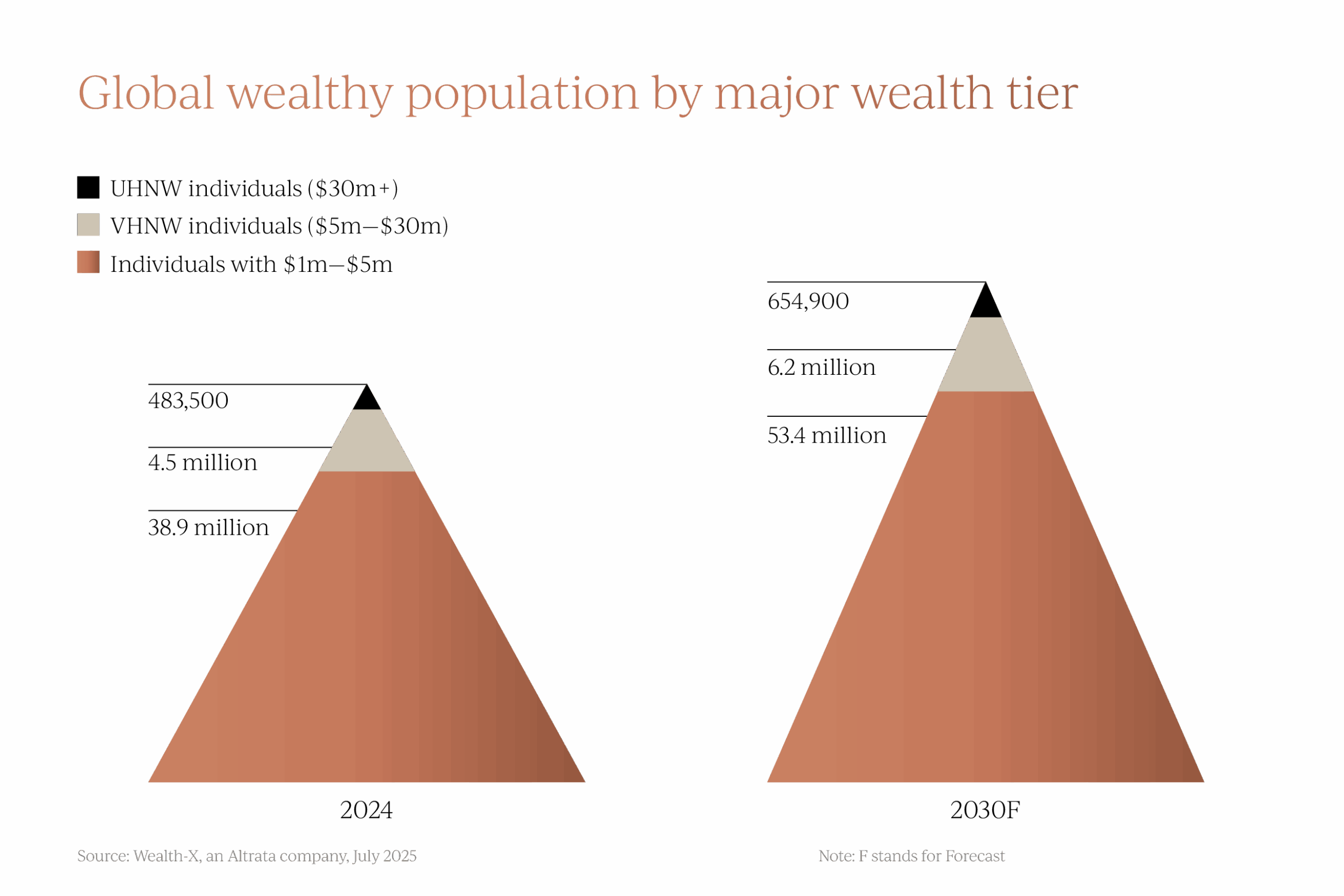

Despite global turbulence, the long-term growth of wealth is undeniable.

The number of people with assets above $1 million is expected to increase by more than one-third by 2030.

That growth, driven by technological innovation, the energy transition, and intergenerational succession, will sustain demand for secure and transparent property markets. For all its challenges, the UK continues to offer those qualities.

So, what does all this mean for buyers, sellers, and advisers?

It means opportunity and competition will continue to coexist. London and pockets of the UK property market remain magnets for global capital seeking stability and lifestyle, but that same mobility ensures international buyers will continue to influence demand.

At Garrington, our focus is to help clients interpret these trends, combining global intelligence with local expertise. Whether you are acquiring your first UK property or expanding an international portfolio, do get in touch with us to see if we can assist you.

Download your copy of our full research paper, in conjunction with REALM and Wealth-X Altrata. This comprehensive report delves deeper into the themes we have covered, lists emerging locations, and offers wider predictions on future trends.

We hope you found this useful. We look forward to bringing you our analysis of the Autumn Statement in a couple of weeks’ time and outlining what it means for the UK property market.